RIYADH Development Co. announces its Interim Consolidated Financial results for the Period Ending on 2025-09-30 ( Nine Months )

| Element List | Current Period | Similar period for previous year | %Change |

|---|---|---|---|

| Sales/Revenue | 310.3 | 235.1 | 31.986 |

| Gross Profit (Loss) | 221.7 | 146.3 | 51.537 |

| Operational Profit (Loss) | 171.6 | 88.1 | 94.778 |

| Net profit (Loss) | 251.5 | 206.6 | 21.732 |

| Total Comprehensive Income | 251.5 | 206.6 | 21.732 |

| Total Shareholders Equity (after Deducting Minority Equity) | 4,082 | 2,454 | 66.34 |

| Profit (Loss) per Share | 1.12 | 1.16 | |

| All figures are in (Millions) Saudi Arabia, Riyals | |||

| Element List | Amount | Percentage of the capital (%) | |

|---|---|---|---|

| Profit (Losses) Resulting From The Change In Investment Propertie’s Fair Value | - | - | |

| All figures are in (Millions) Saudi Arabia, Riyals | |||

| Element List | Explanation |

|---|---|

| The reason of the increase (decrease) in the sales/ revenues during the current quarter compared to the same quarter of the last year is |

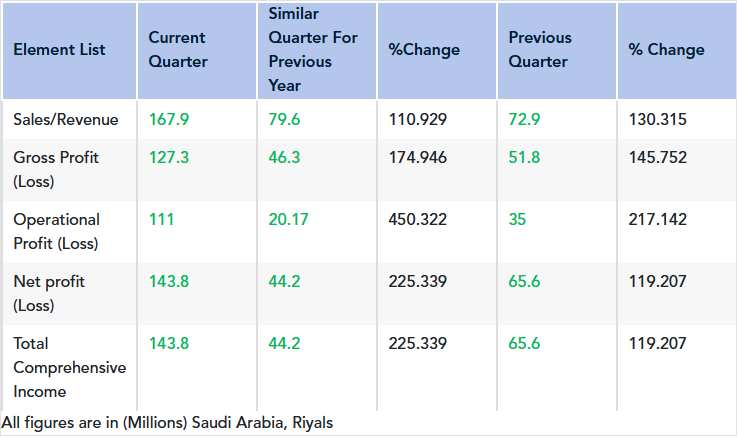

The company achieved revenue from main operations of SAR 167.9 million, an increase of SAR 88.3 million or 111%. This is mainly attributed to:

1. Increase of centers and markets revenue by SAR 4 million, after excluding the impact of revenue from the Al-Tameer Center, which was transferred to Dira Development Company as an in-kind contribution starting from December 2024. 2. Partial sale of the company’s non-strategic lands at a value of SAR 97 million, in line with the company’s strategy to maximize return on unutilized assets. |

| The reason of the increase (decrease) in the net profit during the current quarter compared to the same quarter of the last year is |

The company achieved a net profit of SAR 143.8 million, an increase of SAR 99.6 million, or 225%. This is mainly attributed to:

1. The increase in the main operations revenue by SAR 88.2 million, that was offset by an increase in cost of revenue by SAR 7.3 million, which led to an increase in gross profit by SAR 81 million. 2. The increase of our shares in the associate com-panies by SAR 11 million. 3. The decrease in general and administrative expenses by SAR10 million due to improved efficiency and lower doubtful debts provision as a result of improved collection levels in the company’s markets and centers. |

| The reason of the increase (decrease) in the sales/ revenues during the current quarter compared to the previous one is | The company achieved revenue from main operations of SAR 167.9 million, an increase of SAR 95 million or 130%. This is mainly attributed to the partial sale of the company’s non-strategic lands, in line with the company’s strategy to maxim-ize return on unutilized assets. |

| The reason of the increase (decrease) in the net profit (loss) during the current quarter compared to the previous one is |

The company achieved a net profit of SAR 143.8 million, an increase of SAR 78.2 million or 119%. This is mainly attributed to:

1.The partial sale of the company’s non-strategic lands, in line with the company’s strategy to maximize return on unutilized assets. 2.The increase of our shares in the associate companies. It is worth noting that during the previous quarter, the company recorded a Gain of SAR 15 million from the revaluation of its investment in ANB Capital Arriyadh Development Real Estate Fund. |

| The reason of the increase (decrease) in the sales/ revenues during the current period compared to the same period of the last year is |

The company achieved a net profit of SAR 310.3 million, an in-crease of SAR 75.2 million or 32%. This is mainly attributed to:

1.The partial sale of the company’s non-strategic lands at a value of SAR 97 million, in line with the company’s strategy to maximize return on unutilized assets. 2.Increase of SAR 13 million in revenues from the com-pany’s markets and centers. 3.Increase of real estate development management activities revenue by SAR 2.5 million.

This is despite the fact that the results of the corresponding peri-od included a revenue of SAR 37 million from Al-Tameer Cen-ter, which was transferred to Dira Development Company for Real Estate Development and Investment as an in-kind contribu-tion starting from December 2024. |

| The reason of the increase (decrease) in the net profit during the current period compared to the same period of the last year is |

The company achieved a net profit of SAR 251.5 million, an increase of SAR 45 million or 21.7%. This is mainly attributed to:

1.Increase of centers and markets revenue by SAR 13 million, after excluding the impact of revenue from the Al-Tameer Center, which was contributed in kind to the company "Tameer Al-Deera for Development and Real Estate Investment" starting from December 2024. 2.The partial sale of the company’s non-strategic lands, in line with the company’s strategy to maximize return on unutilized assets. 3.Gain of SAR 15 million from the revaluation of its investment in ANB Capital Arriyadh Development Real Estate Fund. 4.Decrease in general and administrative expenses by SAR 8 million due to improved efficiency and lower doubtful debts provision as a result of improved collection levels in the company’s markets and centers. 5.Decrease in Zakat provision by SAR 10 million, due to the corresponding period including an additional provision related to the years from 2015 to 2018. Note that the company obtained the final Zakat assessments up to the year 2024.

Despite the fact that the profits of the corresponding period included the following: -Profit from the sale of lands by the associate company “Tanal” by SAR 78 million. -The reversal of a potential liability provision by SAR 27 million. |

| Statement of the type of external auditor's report | Unmodified conclusion |

| Comment mentioned in the external auditor’s report, mentioned in any of the following paragraphs (other matter, conservation, notice, disclaimer of opinion, or adverse opinion) | None |

| Reclassification of Comparison Items | Reclassification of comparative figures compatible with the display tab for the current period. |

| Additional Information |

• The weighted average number of ordinary shares outstanding during Period of 2025 is the number of ordinary shares outstanding at the beginning of the period, adjusted by the number of ordinary shares issued during the period multiplied by a time-weighting factor. The time-weighting factor is the number of days that the shares are outstanding during the period in accordance with IAS 33 (Note No. 18 in the financial statement).

• On 22 September 2025, Al-Rimal Logistics Park Company was established as a limited liability company (one-person company) wholly owned by Arriyadh Development Company with a cash capital of SAR (10,000), divided into (10,000) shares, and approximately 98,000sqm of technical services land were transferred to Al-Rimal Logistics Park Company, as per the company strategy: "Invest for Growth." • On 5 October 2025, Hulul Salasil Imdad Almontajat Altazija Company was established with a cash capital of SAR 500,000, divided into (500,000) shares wholly owned by Arriyadh Development Company, as per the company strategy: "Invest for Growth." |