The Kingdom of Saudi Arabia's flag

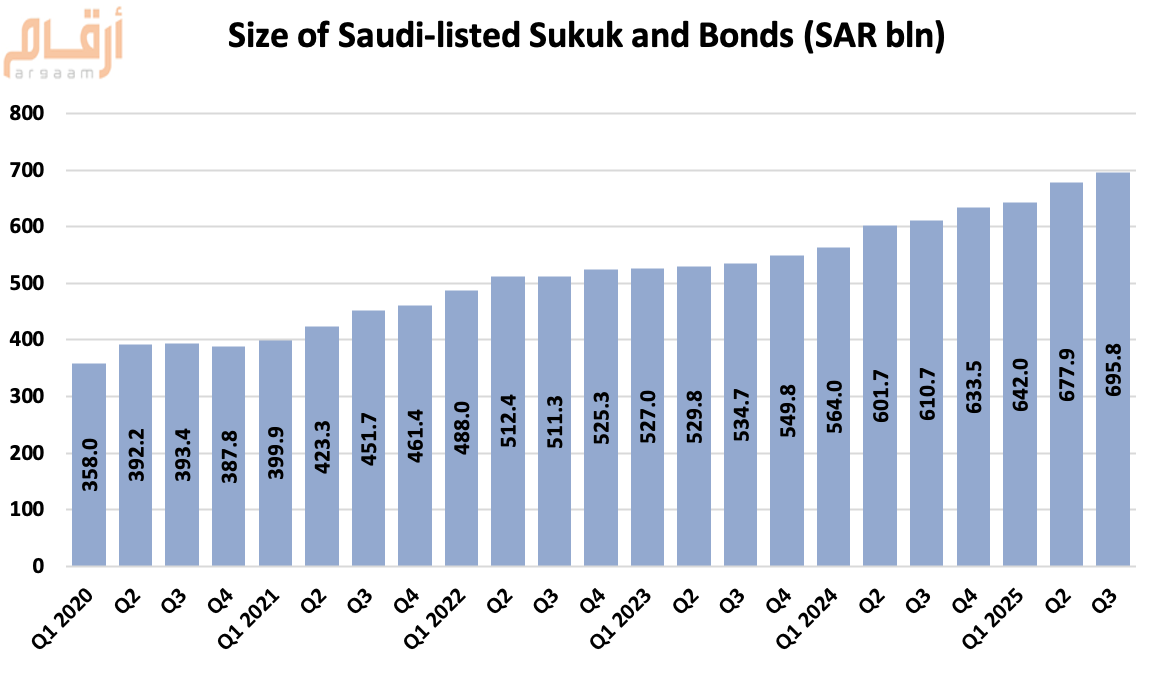

The total value of Saudi-listed sukuk and bonds rose to SAR 695.8 billion at the end of Q3 2025, up 3% quarter-on-quarter (QoQ), according to Tadawul’s quarterly debt market report.

Traded value dropped 89% to SAR 1.78 billion from SAR 16 billion in Q2.

Executed trades totaled 10,414, compared to 12,251 in Q2.

The number of listed sukuk/bond issuances stood at 60, down from 61 in Q2 2025.

Listed sukuk/bonds as a share of GDP edged up to 18.4% from 18.2% in Q2 2025.

|

Listed Sukuk/Bond Size |

|||

|

Period |

Value (SAR bln) |

QoQ Change (SAR bln) |

QoQ Change |

|

Q1 2020 |

358.0 |

-- |

-- |

|

Q2 |

392.2 |

+ 34.2 |

+10% |

|

Q3 |

393.4 |

+ 1.2 |

+0.3% |

|

Q4 |

387.8 |

(5.6) |

(1%) |

|

Q1 2021 |

399.9 |

+ 12.1 |

+3% |

|

Q2 |

423.3 |

+ 23.3 |

+6% |

|

Q3 |

451.7 |

+ 28.5 |

+7% |

|

Q4 |

461.4 |

+ 9.7 |

+2% |

|

Q1 2022 |

488.0 |

+ 26.6 |

+6% |

|

Q2 |

512.4 |

+ 24.4 |

+5% |

|

Q3 |

511.3 |

(1.1) |

(0.2%) |

|

Q4 |

525.3 |

+ 14.1 |

+3% |

|

Q1 2023 |

527.0 |

+ 1.6 |

+0.3% |

|

Q2 |

529.8 |

+ 2.8 |

+1% |

|

Q3 |

534.7 |

+ 5.0 |

+1% |

|

Q4 |

549.8 |

+ 15.1 |

+3% |

|

Q1 2024 |

564.0 |

+ 14.2 |

+3% |

|

Q2 |

601.7 |

+ 37.7 |

+7% |

|

Q3 |

610.7 |

+ 9.0 |

+1% |

|

Q4 |

633.5 |

+ 22.8 |

+4% |

|

Q1 2025 |

642.0 |

+ 8.5 |

+1% |

|

Q2 |

677.9 |

+ 35.9 |

+6% |

|

Q3 |

695.8 |

+ 17.9 |

+3% |

Government sukuk and bonds accounted for 97.6% of total listed debt at end-period, reaching SAR 679.1 billion.

Corporate sukuk and bonds made up the remaining 2.4%, or SAR 16.7 billion.

|

Details of Listed Sukuk/Bonds: |

||||

|

Period |

Govt Sukuk & Bonds |

Corporate Sukuk & Bonds |

||

|

Value (SAR bln) |

% of Total |

Value (SAR bln) |

% of Total |

|

|

Q1 2020 |

334.9 |

93.5 % |

23.1 |

% 6.5 |

|

Q2 |

369.6 |

94.2 % |

22.6 |

% 5.8 |

|

Q3 |

370.8 |

94.2 % |

22.6 |

% 5.8 |

|

Q4 |

365.7 |

94.3 % |

22.1 |

% 5.7 |

|

Q1 2021 |

377.8 |

4.5 % |

22.1 |

% 5.5 |

|

Q2 |

401.3 |

94.8 % |

22.0 |

% 5.2 |

|

Q3 |

429.7 |

95.1 % |

22.0 |

% 4.9 |

|

Q4 |

439.8 |

95.3 % |

21.6 |

% 4.7 |

|

Q1 2022 |

466.4 |

95.6 % |

21.6 |

% 4.4 |

|

Q2 |

496.8 |

97.0 % |

15.6 |

% 3.0 |

|

Q3 |

499.6 |

97.7 % |

11.7 |

% 2.3 |

|

Q4 |

503.9 |

95.9 % |

21.4 |

% 4.1 |

|

Q1 2023 |

505.6 |

95.9 % |

21.4 |

% 4.1 |

|

Q2 |

509.7 |

96.2 % |

20.0 |

3.8 % |

|

Q3 |

514.7 |

96.3 % |

20.0 |

3.7 % |

|

Q4 |

529.8 |

96.4 % |

20.0 |

3.6 % |

|

Q1 2024 |

547.4 |

97.1 % |

16.5 |

2.9 % |

|

Q2 |

585.2 |

97.2 % |

16.5 |

2.7 % |

|

Q3 |

594.2 |

97.3 % |

16.5 |

2.7 % |

|

Q4 |

617.0 |

97.4 % |

16.5 |

2.6 % |

|

Q1 2025 |

625.4 |

97.4 % |

16.6 |

2.6 % |

|

Q2 |

661.2 |

97.5 % |

16.7 |

2.5 % |

|

Q3 |

679.1 |

97.6 % |

16.7 |

2.4 % |

Saudi holdings of listed debt instruments totaled SAR 677.4 billion at the end of Q3 2025, representing 97.4% of the total.

On the other hand, foreign investors held about SAR 15 billion, while GCC investors owned SAR 3.4 billion.

|

Holdings by Nationality |

||

|

Nationality |

Value (SAR bln) |

% of Total |

|

Saudis |

677.39 |

97.4 % |

|

Foreign Investors |

15.01 |

2.2 % |

|

GCC Investors |

3.36 |

0.5 % |

|

Total |

695.76 |

100 % |

Be the first to comment

Comments Analysis: