Tamkeen Human Resource Co. announces its Interim Financial results for the Period Ending on 2025-06-30 ( Six Months )

| Element List | Current Period | Similar period for previous year | %Change |

|---|---|---|---|

| Sales/Revenue | 508 | 314.7 | 61.423 |

| Gross Profit (Loss) | 95.6 | 62.9 | 51.987 |

| Operational Profit (Loss) | 52.2 | 34.2 | 52.631 |

| Net profit (Loss) | 53 | 37.3 | 42.091 |

| Total Comprehensive Income | 54.2 | 36.9 | 46.883 |

| Total Shareholders Equity (after Deducting Minority Equity) | 348 | 302.2 | 15.155 |

| Profit (Loss) per Share | 2 | 1.4 | |

| All figures are in (Millions) Saudi Arabia, Riyals | |||

| Element List | Amount | Percentage of the capital (%) | |

|---|---|---|---|

| Profit (Losses) Resulting From The Change In Investment Propertie’s Fair Value | - | - | |

| Accumulated Losses | - | - | |

| All figures are in (Millions) Saudi Arabia, Riyals | |||

| Element List | Explanation |

|---|---|

| The reason of the increase (decrease) in the sales/ revenues during the current quarter compared to the same quarter of the last year is |

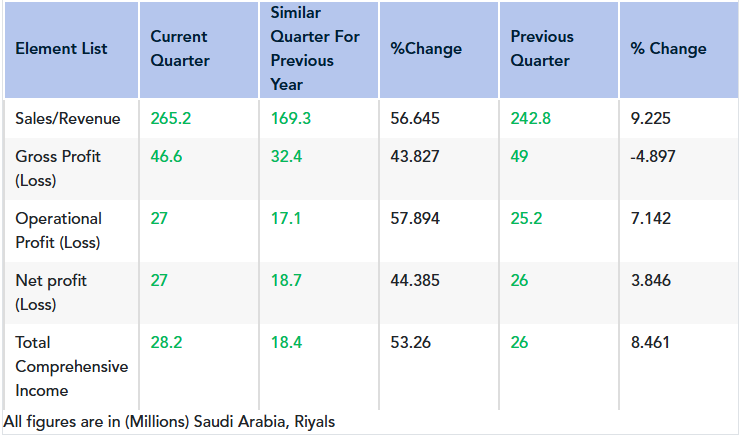

The Company’s consolidated revenue for the second quarter of 2025 increased by SAR 95.9 million, representing a growth of 56.6% compared to the same quarter of the previous year. This growth is primarily attributable to the following factors:

Revenues from the Corporate and Subsidiaries segment recorded a substantial increase of 74.7%, amounting to SAR 89.9 million. This performance was driven by a 68.8% rise in the average number of deployed resources, in response to growing customer demand across various corporate activities.

The Individual Services segment also witnessed a revenue increase of 12.2%, supported by a 7.6% growth in the average number of deployed resources. |

| The reason of the increase (decrease) in the net profit during the current quarter compared to the same quarter of the last year is |

The Company recorded a net profit growth of 44.3% during the second quarter of the current year compared to the same quarter of the previous year. Net profit reached SAR 27.0 million in Q2 2025, compared to SAR 18.7 million in Q2 2024. This increase is primarily attributable to the following factors:

A 56.6% increase in the Group’s revenue compared to the same quarter of the previous year.

Gross profit rose by 44.0% year-over-year, driven by improved performance across both the Corporate and Subsidiaries segment and the Individual Services segment. Revenues from the Corporate and Subsidiaries segment increased by 74.7%, resulting in a 45.7% increase in the gross profit of that segment. The Individual Services segment also posted a 35.0% increase in gross profit.

Operating profit grew by 58.0% compared to Q2 2024, despite a 4.6% increase in general and administrative expenses and marketing expenses. In addition, the expected credit loss provision increased by SAR 3.7 million, in accordance with the expected credit loss model developed by the external advisor. This adjustment reflects the rise in trade receivables, which is a direct result of the increase in the Company’s revenues. |

| The reason of the increase (decrease) in the sales/ revenues during the current quarter compared to the previous one is |

The Company’s consolidated revenues for Q2 2025 increased by SAR 22.4 million, representing a 9.2% growth compared to the previous quarter, primarily driven by:

Corporate and subsidiaries services revenues recorded a notable growth of 9.6%, amounting to SAR 18.4 million, driven by a 3.5% increase in the average number of deployed resources in response to rising client demand across various corporate sector activities. Additionally, individual services revenues grew by 7.7%, supported by a 4.3% increase in the average number of deployed resources |

| The reason of the increase (decrease) in the net profit (loss) during the current quarter compared to the previous one is |

The Company recorded a net profit growth of 4.0% during the second quarter of 2025 compared to the previous quarter, with net profit reaching SAR 27.0 million in Q2 2025, up from SAR 26.0 million in Q1 2025. This increase is primarily attributable to the following factors:

- An increase of 9.2% in the Company’s consolidated revenue compared to the previous quarter.

- Gross profit declined by 5.0% quarter-over-quarter, mainly due to a 3.9% decrease (equivalent to SAR 1.6 million) in gross profit from the Corporate and Subsidiaries segment, reflecting intensified market competition. Additionally, gross profit from the Individual Services segment declined by 10.9% (SAR 0.84 million), impacted by seasonally driven price reductions.

- Operating profit increased by 7.3% compared to the previous quarter, primarily driven by a 24.2% reduction in general and administrative expenses as well as marketing expenses. The decrease in expenses was mainly attributed to a lower provision for losses on advances to external recruitment agencies and reduced marketing spend influenced by seasonality. Furthermore, the expected credit loss provision increased by SAR 0.5 million, in line with the expected credit loss model developed by the external advisor, reflecting the rise in trade receivables a direct result of the increase in Company revenues. |

| The reason of the increase (decrease) in the sales/ revenues during the current period compared to the same period of the last year is |

- The Company’s consolidated revenue for the first half of 2025 increased by SAR 193.3 million, representing a growth of 61.4% compared to the first half of 2024. This increase is primarily attributable to the following factors:

- Revenues from the Corporate and Subsidiaries segment recorded a significant increase of 85.2%, amounting to SAR 185.0 million. This growth was driven by an 84.3% rise in the average number of deployed resources, reflecting heightened demand from clients across various corporate service activities.

- The Individual Services segment also recorded a revenue increase of 8.6%, supported by a 6.0% increase in the average number of deployed resources. |

| The reason of the increase (decrease) in the net profit during the current period compared to the same period of the last year is |

The Company recorded a net profit growth of 42.4% during the first half of 2025 compared to the first half of 2024, with net profit reaching SAR 53.0 million, up from SAR 37.3 million in the same period of the previous year. This increase is primarily attributable to the following factors:

An increase of 61.4% in the Company’s consolidated revenue compared to the first half of 2024.

Gross profit rose by 52.1% year-over-year, mainly driven by a 64.3% increase in gross profit from the Corporate and Subsidiaries segment, as well as an 8.0% increase in gross profit from the Individual Services segment.

Operating profit increased by 52.6% compared to the first half of 2024, despite a 27.3% increase in general and administrative expenses and marketing expenses. The rise in expenses was mainly due to higher provisions for losses on advances to external recruitment agencies and increased employee salaries and benefits, reflecting the Company’s ongoing investment in human capital. Additionally, the expected credit loss provision increased by SAR 7.4 million, in accordance with the expected credit loss model developed by the external advisor. This adjustment aligns with the increase in trade receivables, which is a direct consequence of the Company’s revenue growth. |

| Statement of the type of external auditor's report | Other Matter |

| Comment mentioned in the external auditor’s report, mentioned in any of the following paragraphs (other matter, conservation, notice, disclaimer of opinion, or adverse opinion) | The financial statements of the company for the year ended December 31, 2024, were audited by another auditor, who issued an unmodified audit report dated 27 Ramadan 1446H (Corresponding to March 27, 2025G). For the three month and six month periods ended June 30, 2024, the auditor expressed an unmodified conclusion dated 21 Rabi Al Awwal1446H (Corresponding to September 30, 2024G). |

| Reclassification of Comparison Items | Certain comparative figures have been reclassified to conform with the classification adopted for the period ended 30 June 2025. |

| Additional Information | None |

Comments {{getCommentCount()}}

Be the first to comment

رد{{comment.DisplayName}} على {{getCommenterName(comment.ParentThreadID)}}

{{comment.DisplayName}}

{{comment.ElapsedTime}}

Comments Analysis: