The Saudi flag against Riyadh’s skyline

Saudi Arabia’s economy saw several significant developments in 2025, most notably a series of decisions affecting the real estate sector.

Crown Prince Mohammed bin Salman said the Saudi economy continued to diversify its growth drivers and strengthen its ability to reduce dependence on oil.

The year also witnessed major geopolitical developments with economic repercussions, most notably a trade war triggered by tariffs imposed by the United States on several countries, led by China and Europe.

During 2025, the US Federal Reserve cut interest rates three times, by a cumulative 75 basis points, at its September, November, and December meetings, bringing the target range to 3.50%–3.75%.

The Public Investment Fund (PIF) launched Al Waha Duty-Free Co., which specializes in duty-free retail, as well as a company to develop and operate Expo 2030 Riyadh facilities, and established its first commercial paper program.

Meanwhile, the Ministry of Industry and Mineral Resources launched standard incentives for the industrial sector, allocating SAR 10 billion for their implementation. The number of companies that established regional headquarters in the Kingdom rose to 682.

Below is a chronological overview of key developments:

1. Launch of standard incentives for the industrial sector

The Ministry of Industry and Mineral Resources, in cooperation with the Ministry of Investment, announced the launch of standard incentives for the industrial sector during a ceremony held in Riyadh, with SAR 10 billion allocated to the initiative.

2. Listed firms receive Aramco notices on feedstock and fuel prices

Several companies listed on the Saudi stock market said they had received notices from Saudi Aramco regarding adjustments to feedstock and fuel prices, effective Jan. 1, 2025.

3. Ministry launches 15 enablers under Saudi AEO program

The Ministry of Industry and Mineral Resources launched 15 enablers and incentives for entities enrolled in the Saudi Authorized Economic Operator (Saudi AEO) program, highlighting the program’s role in boosting the competitiveness of Saudi exports, improving access to global markets, and reinforcing the Kingdom’s position as a global logistics hub.

4. Saudi Electricity settles historical obligations worth SAR 5.7 billion

Saudi Electricity Co. said it had received approval from a ministerial committee overseeing electricity sector restructuring to adopt a final settlement of long-disputed amounts related to technical differences in fuel quantities and prices, handling costs, and electricity charges.

The committee approved a final settlement of SAR 5.69 billion, payable by the company to the government, represented by the Ministry of Finance. The amount will be converted into a Mudarabah instrument in line with an agreement signed between the company and the ministry, within 30 days from Jan. 31, 2025.

5. Launch of second and third phases of Riyadh Road Development Program

The Royal Commission for Riyadh City (RCRC) announced the start of the second phase of the Main and Ring Road Axes Development Program, comprising eight projects with a total cost exceeding SAR 8 billion.

In December, the commission also announced the launch of the third phase, which includes six projects with a combined cost exceeding SAR 8 billion.

6. Crown Prince names automotive manufacturing zone

Crown Prince Mohammed bin Salman announced that the designated automotive manufacturing zone within the Special Economic Zone at King Abdullah Economic City will be named the “King Salman Automotive Cluster.”

7. Launch of aircraft manufacturing and maintenance industrial zone

Saudi Arabia launched its first industrial zone dedicated to aircraft manufacturing and maintenance in Jeddah during the Aerospace Connect Forum held in the city.

8. Inauguration of first phase of Sports Boulevard

The board of the Sports Boulevard Foundation, chaired by Crown Prince and Prime Minister Mohammed bin Salman, inaugurated the first phase of the Sports Boulevard project, which includes five destinations.

9. Saudi Arabia submits Expo 2030 registration dossier

Saudi Arabia submitted the official registration dossier for Expo 2030 Riyadh to the Bureau International des Expositions (BIE), reaffirming its readiness to host the global event.

In June, the dossier received final approval during the BIE General Assembly meeting in Paris, completing the host country registration process. The Saudi delegation also received the Expo flag.

In October, Expo 2030 Riyadh officially received the BIE flag during the closing ceremony of Expo 2025 Osaka, which concluded after six months of events in Japan.

10. PIF launches Al Waha duty-free retailer

The Public Investment Fund announced the launch of Al Waha Duty-Free Co., which specializes in travel retail and will be the first Saudi-owned operator of duty-free retail outlets.

11. S&P raises Saudi Arabia’s credit rating

Standard & Poor’s upgraded Saudi Arabia’s sovereign credit rating to A+ from A, with a stable outlook.

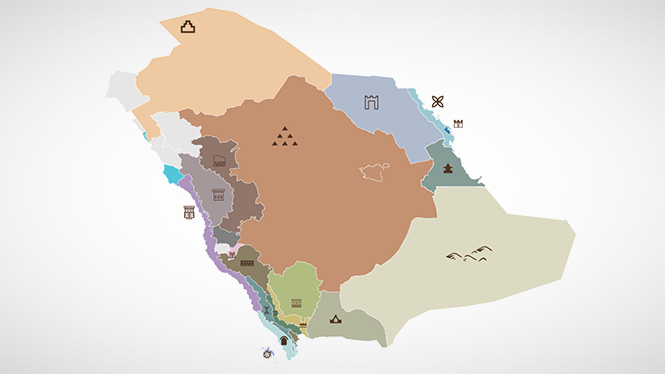

12. Crown Prince launches Saudi Architecture Characters Map

Crown Prince Mohammed bin Salman launched the Saudi Architecture Characters Map, which features 19 architectural styles inspired by the Kingdom’s geographic and cultural characteristics. The initiative aims to celebrate architectural heritage, enhance quality of life, and modernize the urban landscape as part of Vision 2030.

13. Measures announced to restore balance in Riyadh’s real estate sector

Crown Prince Mohammed bin Salman, in his capacity as prime minister, directed the adoption of several measures based on studies conducted by the Royal Commission for Riyadh City and the Council of Economic and Development Affairs to address rising land and rental prices in Riyadh, with the aim of restoring balance to the real estate sector.

14. Approval of executive regulations of the Investment Law

Saudi Arabia’s minister of investment approved the executive regulations of the Investment Law to support its implementation and achieve its stated objectives.

15. Cabinet approves amendment to idle land fees regulation

The Saudi cabinet, chaired by Crown Prince Mohammed bin Salman, approved amendments to the idle land fees regulation.

The Ministry of Municipalities and Housing said it had adopted and implemented the executive regulations for the White Land Tax, setting the tax rate at up to 10% of land value in line with urban development priorities.

Minister of Municipal, Rural Affairs, and Housing Majed Al-Hogail also announced the geographic scope of the White Land fees in Riyadh, a step aimed at regulating the real estate market and promoting balanced urban development.

16. US tariffs take effect

In April 2025, US tariffs on a wide range of countries came into force, affecting around 60 US trading partners.

US President Donald Trump signed an executive order amending reciprocal tariffs imposed on dozens of countries, stipulating that goods deemed to have been rerouted to circumvent applicable tariffs would be subject to an additional 40% levy.

17. Energy Minister announces new oil and gas discoveries

Energy Minister Prince Abdulaziz bin Salman said Saudi Aramco had made 14 new discoveries of oil and natural gas fields and reservoirs in the Eastern Province and the Empty Quarter.

The discoveries include six oil fields and two oil reservoirs, as well as two gas fields and four gas reservoirs.

18. Cabinet approves amendments to housing subsidy regulations

The cabinet, chaired by Crown Prince Mohammed bin Salman, approved amendments to housing subsidy regulations, according to the decision.

19. Royal decree extends downstream tax to end-2030

Saudi Arabia’s King Salman bin Abdulaziz issued a royal decree approving the extension of the tax applied to the taxable base of taxpayers engaged in downstream activities until Dec. 31, 2030.

20. PIF launches company to build and operate Expo 2030 Riyadh facilities

The Public Investment Fund launched Expo 2030 Riyadh Co., which will be responsible for building and operating the exhibition’s facilities and investing in them over the long term.

21. PIF establishes first commercial paper program

The Public Investment Fund established its first commercial paper program, saying the move adds a new financing instrument to its existing funding tools.

22. Fitch affirms Saudi Arabia’s A+ rating with 'Stable' outlook

Fitch Ratings affirmed Saudi Arabia’s credit rating at A+ with a stable outlook, according to its report, reflecting the strength of the Kingdom’s financial position.

23. Privatization of 3 clubs via public offering

The Ministry of Sport, in cooperation with the National Center for Privatization, announced the privatization of the first three Saudi sports clubs through public offerings—Al-Ansar, Al-Kholood, and Al-Zulfi—with ownership transferred to investment entities.

24. Crown Prince affirms Saudi economy advancing in diversification

Crown Prince Mohammed bin Salman said the Saudi economy is moving forward in diversifying its pathways and reinforcing its ability to reduce dependence on oil.

25. Approval of expropriation law for public benefit, temporary property taking

Saudi Cabinet, chaired by the Custodian of the Two Holy Mosques King Salman bin Abdulaziz, approved law of expropriation of real estate for public benefit and temporary taking of property. The law aims to enhance governance of expropriation and temporary seizure procedures, ensure fair compensation, protect public funds, and support sustainable development.

26. PIF acquires 54% stake in MBC Group for SAR 7.5B

MBC Group announced the completion of the Public Investment Fund’s (PIF) acquisition of a 54% stake in the company’s total capital for SAR 7.47 billion, following notification from the Fund.

27. Approval of regulations governing landlord–tenant relationship

A Cabinet decision and Royal Decree were issued approving regulatory provisions governing the relationship between landlords and tenants, in implementation of directives by Crown Prince Mohammed bin Salman to roll out a new regulatory package for the Riyadh rental market, in response to challenges related to rising residential and commercial rental prices.

28. Opening of Shura Island with 3 world-class

Red Sea Global, a PIF company, announced in September the opening of its first resorts and tourist attractions on Shura Island.

29. Finance Minister says focus is on economic growth, not tax increases

Saudi Finance Minister Mohammed Al-Jadaan said the Kingdom is working to expand the size of the domestic economy, increase revenues, and reduce debt, stressing that there is no intention to raise taxes or tax burdens.

30. Launch of 'King Salman Gate' in Makkah

Crown Prince Mohammed bin Salman, Prime Minister and Chairman of Rua Al Haram Al Makki Co., announced the launch of the King Salman Gate as a transformative multi-use development in Makkah.

31. 682 companies establish regional HQs in Riyadh

The number of global companies licensed to establish regional headquarters in Riyadh reached 682 from the program’s launch through the third quarter of 2025.

32. Draft proposal issued to open TASI to non-resident foreign investors

The Capital Market Authority (CMA) released in October a draft proposal to open the Main Market (TASI) to all categories of non-resident foreign investors and enable them to invest directly, for public consultation.

33. Private sector contribution to economy rises to 51%

Investment Minister Khalid Al-Falih said the private sector’s contribution to the Saudi economy increased from 40% in 2016 to 51% currently.

34. $11B deal completed in Jafurah project

Saudi Aramco completed an $11 billion investment agreement under a lease-and-leaseback structure for gas processing facilities at Jafurah, with a consortium of international investors.

35. Aramco acquires minority stake in HUMAIN

The PIF and Saudi Aramco signed a non-binding term sheet outlining key terms for Aramco to acquire a significant minority stake in HUMAIN, which is owned by the PIF.

36. Saudi Arabia’s direct, indirect dependence on oil falls to 68%

Minister of Economy and Planning Faisal Al-Ibrahim said the Kingdom’s direct and indirect dependence on oil declined from over 90% to 68%.

37. Opening Nomu to new categories of investors

The CMA’s board approved opening the Parallel Market (Nomu) to holders of bachelor’s degrees in certain securities-related fields as qualified investors, as part of a package of amendments easing criteria and requirements for investor qualification in Nomu.

38. Launch of unified interactive map to showcase Riyadh infrastructure projects

The Riyadh Infrastructure Projects Center (RIPC) launched a unified interactive digital map showcasing details of infrastructure projects in Riyadh and its governorates, enhancing transparency, project execution quality, and the urban landscape.

39. Opening of AMAALA destination

Red Sea Global (RSG) announced the opening of the AMAALA destination in November, noting that investments for developing the first phase amounted to SAR 51.04 billion.

40. Saudi Arabia plans to raise investments in US to $1T

Crown Prince Mohammed bin Salman said Saudi Arabia will increase its investments in the US to $1 trillion, stressing that the Kingdom invests in real opportunities—not symbolic ones—across sectors such as semiconductors and AI.

41. $270B agreements between Saudi Arabia, US

US President Donald Trump said agreements worth an estimated $270 billion were signed between Saudi Arabia and dozens of companies.

42. OPEC+ extends suspension of output increases until March 2026 on seasonal factors

The eight countries participating in the OPEC+ agreement reaffirmed their Nov. 2, 2025 decision to suspend production increases during January, February, and March 2026 due to seasonal factors. OPEC+ also reaffirmed total crude oil production levels until Dec. 31, 2026, as agreed at the 38th ministerial meeting.

43. The 2026 budget

The Ministry of Finance announced the estimated 2026 budget, with total expenditures projected at SAR 1.31 trillion and revenues at SAR 1.14 trillion, resulting in an expected deficit of SAR 165.4 billion.

44. Saudi Arabia, Qatar ink deal to build high-speed electric rail link

Crown Prince Mohammed bin Salman and Qatar’s Emir Sheikh Tamim bin Hamad Al Thani witnessed the signing of an agreement to implement a high-speed electric passenger rail project between Saudi Arabia and Qatar.

45. Six Flags Opening

Qiddiya Investment Co. (QIC) opens its first asset today, Dec. 31, the first Six Flags theme park.

46. PIF offers 48M Masar shares to institutional investors

The PIF decided to offer 48 million shares of Umm Al Qura for Development and Construction Co. (Masar) to institutional investors, representing approximately 3.3% of the company’s issued capital.

47. Cancellation of levy on expatriate labor in industrial facilities

The Cabinet, chaired by Crown Prince Mohammed bin Salman, approved the cancellation of the levy imposed on expatriate workers employed at licensed industrial facilities.

48. Fed cuts interest rates by a total of 75 bps

The US Federal Reserve cut interest rates three times—by a total of 75 basis points—at its September, November, and December meetings, bringing rates to a range of 3.50%–3.75%. Given the riyal’s peg to the US dollar, the Saudi Central Bank (SAMA) also cut reverse repo and repo rates three times during the year.

The Fed maintained its projection of one 25- bps rate cut in each of 2026 and 2027.

49. Gold hits record high for first time ever

Gold recorded strong gains in 2025, surpassing $4,550 per ounce to reach an all-time high.

50. Cabinet approves regulatory frameworks for SEZ

The Saudi Cabinet, chaired by King Salman bin Abdulaziz, approved the regulatory frameworks for the special economic zones (SEZ) in Jazan, the Information Cloud Computing Zone, King Abdullah Economic City (KAEC), and Ras Al-Khair.

51. Listing of 15 companies on TASI, 25 on Nomu in 2025

In 2025, 15 companies were listed and began trading on the Main Market (TASI), while 25 companies were listed and began trading on the Parallel Market (Nomu).

Be the first to comment

Comments Analysis: