|

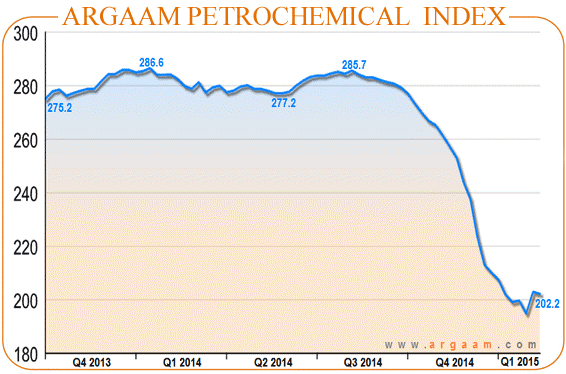

Argaam Petrochemical Index |

|

|

202.2 |

Argaam Index (Feb.15) |

|

(0.4%) |

Weekly change |

|

(28.9%) |

6 months change |

|

(28.5%) |

1-year change |

Argaam Petrochemical Index, which measures the average price changes for a basket of petrochemicals in the Gulf, snapped the previous week’s rally, ending lower at 202.2 points compared to 203 points last week.

Naphtha feedstock rose, building on $35 gain to $545 per ton this week, backed by higher global Brent futures.

Prices of propane and other gas liquids, such as butane are fixed for Saudi Arabian companies at a discount of nearly 28 percent compared to Japan Naphtha prices, minus freight costs.

|

Prices of Naphtha including shipping cost to Japan (Feb.15) |

||||

|

1-yearchange |

6 months change |

Weekly change |

Price |

Product |

|

(41%) |

(38%) |

+7% |

545 |

Naphtha * |

|

(41%) |

(38%) |

+7% |

392 |

Propane ** |

* CFR Japan.

** Approximate price in Saudi Arabia (28% discount for Naphtha).

Argaam Petrochemical Index ended the week in red, battered by declines of heavyweights such as polyethylene and urea, along with hikes in naphtha prices versus higher prices of low-weight constituents on the index.

Ethylene, propylene and benzene increased, buoyed by heavy purchases for stock-building ahead of the 2015 Chinese new year on Feb. 19.

High-density polyethylene dropped almost $40 to $1,120 per ton on low demand and oversupply. Meanwhile, polypropylene prices remained unchanged week-on-week.

Urea and ammonia in global markets fell this week, as seasonal demand slowed in North America, and India had its current needs covered due to to the buy transactions executed last month.

|

Basic Petrochemicals (Feb.15) - Asian markets |

||||

|

1-year change |

6monthschange |

Weekly change |

Price |

Product |

|

(36%) |

(40%) |

+4% |

900 |

Ethylene* |

|

(40%) |

(37%) |

+6% |

850 |

Propylene* |

|

(50%) |

(51%) |

+1% |

660 |

Benzene* |

|

(36%) |

(34%) |

+1% |

965 |

Styrene* |

|

(47%) |

(23%) |

-- |

315 |

Methanol (Methanex)** |

|

(50%) |

(29%) |

+4% |

250 |

Methanol (China)*** |

|

(38%) |

(30%) |

+6% |

690 |

MTBE**** |

* FOB-East Asia (Japan, Taiwan and Korea).

** ACP "Methanex"

*** Methanol prices in China.

**** Spot – Singapore.

|

Polymers Prices (Feb.15) - Asian markets |

||||

|

1yearchange |

6monthschange |

Weekly change |

Price |

Product |

|

(27%) |

(30%) |

(3%) |

1120 |

Polyethylene* |

|

(32%) |

(33%) |

-- |

1020 |

Polypropylene |

|

(36%) |

(34%) |

+1% |

1140 |

Poly Styrene |

|

(22%) |

(22%) |

+2% |

830 |

PVC |

|

(7%) |

(7%) |

-- |

2325 |

PCB |

* FOB-East Asia (Japan, Taiwan and Korea).

** ACP "Methanex"

*** Methanol prices in China.

**** Spot – Singapore.

|

Polymers Prices (Feb.15) - Asian markets |

||||

|

1yearchange |

6monthschange |

Weekly change |

Price |

Product |

|

(27%) |

(30%) |

(3%) |

1120 |

Polyethylene* |

|

(32%) |

(33%) |

-- |

1020 |

Polypropylene |

|

(36%) |

(34%) |

+1% |

1140 |

Poly Styrene |

|

(22%) |

(22%) |

+2% |

830 |

PVC |

|

(7%) |

(7%) |

-- |

2325 |

PCB |

* High density polyethylene.

|

Intermediates (Feb.15) - Asian markets |

|||||||

|

1-year change |

6 months change |

Weekly change |

Price |

Product |

|||

|

(15%) |

(20%) |

+2% |

805 |

Spot MEG - china |

|||

|

(25%) |

(23%) |

-- |

880 |

MEG (SABIC) |

|||

|

(38%) |

(43%) |

-- |

590 |

PTA |

|||

|

Fertilizers (Feb.15) - Gulf Arab |

||||

|

1-year change |

6monthschange |

Weeklychange |

Price |

Product |

|

(19%) |

(7%) |

(2%) |

320 |

Urea |

|

(1%) |

(10%) |

(2%) |

445 |

Ammonia |

|

+17% |

+1% |

-- |

480 |

DAP* |

* Export price from Saudi Arabia

|

Titanium Dioxide (Feb.15) |

||||

|

1-year change change |

6monthschange |

Weekly change |

Price |

Product |

|

(9%) |

(8%) |

-- |

2,575 |

Tio2 (Asia) |

|

(20%) |

(19%) |

-- |

2,555 |

Tio2 (Europe) |

|

(8%) |

(8%) |

-- |

3,190 |

Tio2 (America) |

|

End Products for Saudi petrochemical companies |

|

|

Finished Products |

Company |

|

Polyethylene , polypropylene , poly styrene , ethylene glycol (MEG), methyl tert- butyl ether (MTBE), benzene , urea , ammonia , PVC, and PTA |

SABIC |

|

Urea, ammonia |

SAFCO |

|

Polyethylene, polypropylene, ethylene glycol (MEG), methyl tert- butyl ether (MTBE), benzen. |

YANSAB |

|

Polyethylene, polypropylene, propylene. (TiO2) |

Tasnee |

|

Polyethylene, polypropylene, ethylene glycol (MEG), polycarbonate, and bisphenol A |

Saudi Kayan |

|

Polyethylene, polypropylene, propylene oxide, and refined petroleum product. |

Petro Rabigh |

|

Polyethylene, polypropylene, poly styren. |

Petrochem |

|

Polyethylene, polypropylen. |

Sahara Petrochemicals |

|

Styrene, benzene, Cyclohexene, propylen. |

Saudi Group |

|

Methanol, Butanol, acetic acid, vinyl acetate monomer |

Sipchem |

|

Polypropylene |

Advanced |

|

Polypropylene |

Alujain |

|

Formaldehyde - improvers concrete |

CHEMANOL |

|

Epoxy resin, hydrochloric acid, liquid caustic soda, soda granules |

NAMA |

|

Ammonia and DAP |

MA’ADEN |

About Argaam Petrochemical Index:

Argaam Petrochemical Index is the only index that provides weekly capacity-weighted measures for the average changes of international prices of several petrochemical products manufactured in the Gulf Arab countries.

Internally consumed products, which are used as feedstock for producing other petrochemicals, represent smaller weights on the index. These products— such as ethylene, propylene and ammonia— are not sold regularly in the international market.

Final products sold in international markets such as polyethylene, polypropylene, MTBE, MEG and urea represent the biggest weights on the index.

Naphtha prices, the main feedstock benchmark, correlate negatively with the index. The weights of products on the index are reviewed periodically.

As of January 1, 2002 the index started at 100 points.

Be the first to comment

Comments Analysis: