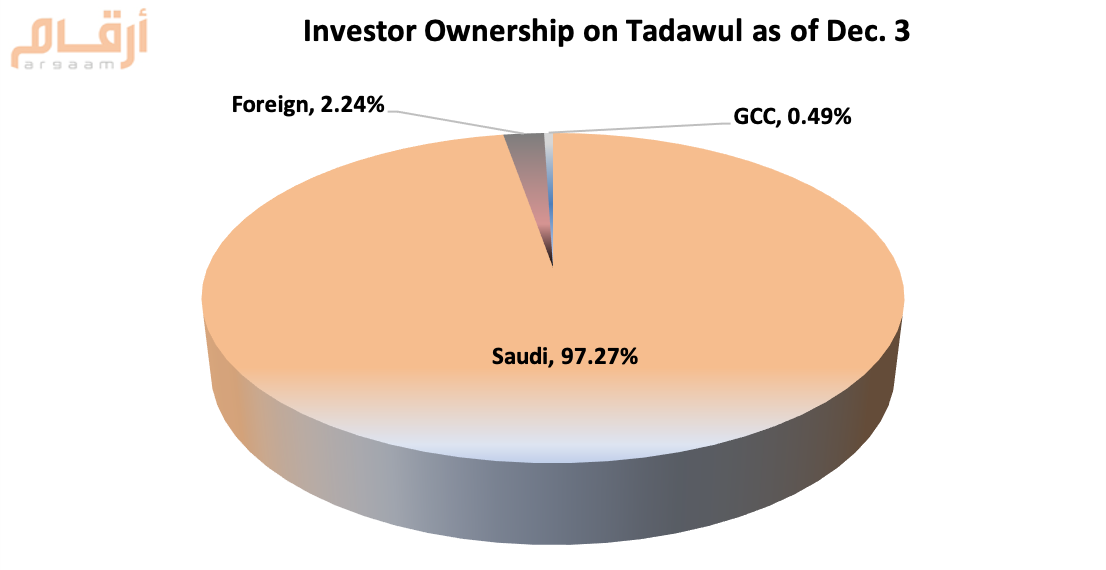

The market capitalization of the Saudi Stock Exchange (Tadawul) inched lower 0.15% to about SAR 9.25 trillion in the week ending Dec. 3, 2020, compared to a week earlier, according to data issued by Tadawul.

Foreign investors' ownership accounted for 2.24% of the total market capital.

|

Ownership Value by Nationality and Investor Type - (SAR bln) |

||||

|

Investor Type |

November 26 |

December 3 |

Variation |

|

|

Saudi Investors |

Retail |

128.2 |

126.4 |

(1.8) |

|

High Net Worth Investors |

181.8 |

184.2 |

+2.4 |

|

|

Individual Professional Investors |

296.9 |

298.8 |

+1.9 |

|

|

Individual DPMs |

6.2 |

6.2 |

-- |

|

|

Total (retail) |

613.1 |

615.6 |

+2.5 |

|

|

Corporate |

621.5 |

620.4 |

(1.1) |

|

|

Mutual Funds |

211.9 |

210.9 |

(1.0) |

|

|

Government Related Entities |

7514.7 |

7503.8 |

(10.9) |

|

|

Institutional DPMs |

51.1 |

51.2 |

+0.1% |

|

|

Total (Corporate Investors) |

8399.2 |

8386.3 |

(12.9) |

|

|

Total (Saudi investors) |

9012.3 |

9001.9 |

(10.4) |

|

|

GCC Investors |

Individuals |

2.6 |

2.6 |

-- |

|

Institutions |

42.6 |

42.6 |

-- |

|

|

DPMs* |

0.3 |

0.3 |

-- |

|

|

Total (GCC investors) |

45.4 |

45.4 |

-- |

|

|

Foreign Investors |

SWAP Holders |

2.1 |

2.1 |

-- |

|

Foreign Resident |

8.2 |

6.4 |

(1.8) |

|

|

QFIs |

158.4 |

157.7 |

(0.7) |

|

|

DPMs* |

1.1 |

1.0 |

(0.1) |

|

|

Strategic Partners |

40.5 |

40.2 |

(0.3) |

|

|

Total (foreign investors) |

210.2 |

207.2 |

(3.0) |

|

|

Total |

9268.0 |

9254.5 |

(13.5) |

|

*Undeposited shares of Amiantit - capital decrease - not included in equity as on Dec. 3

|

Ownership Ratio by Nationality and Investor Type |

||||||||

|

Investor Type |

November 26 |

December 3 |

Variation |

|||||

|

Issued Shares |

Free Float |

Issued Shares |

Free Float |

Issued Shares |

Free Float |

|||

|

Saudi Investors |

Retail |

1.38% |

9.85% |

1.37% |

9.76% |

(0.02%) |

(0.09%) |

|

|

High Net Worth Investors |

1.96% |

13.80% |

1.99% |

14.01% |

0.03% |

0.21% |

||

|

Individual Professional Investors |

3.20% |

16.65% |

3.23% |

16.77% |

0.02% |

0.12% |

||

|

Individual DPMs |

0.07% |

0.48% |

0.07% |

0.48% |

-- |

-- |

||

|

Total (retail) |

6.62% |

40.77% |

6.65% |

41.02% |

0.04% |

0.24% |

||

|

Corporate |

6.71% |

22.36% |

6.70% |

22.29% |

(0.01%) |

(0.07%) |

||

|

Mutual Funds |

2.29% |

11.06% |

2.28% |

11.04% |

(0.01%) |

(0.02%) |

||

|

Government Related Entities |

81.08% |

6.52% |

81.08% |

6.52% |

-- |

-- |

||

|

Institutional DPMs |

0.55% |

3.93% |

0.55% |

3.94% |

-- |

0.01% |

||

|

Total (Corporate Investors) |

90.63% |

43.87% |

90.62% |

43.79% |

(0.01%) |

(0.08%) |

||

|

Total (Saudi investors) |

97.24% |

84.64% |

97.27% |

84.81% |

0.03% |

0.17% |

||

|

GCC Investors |

Individuals |

0.03% |

0.20% |

0.03% |

0.20% |

-- |

-- |

|

|

Institutions |

0.46% |

2.26% |

0.46% |

2.28% |

-- |

0.02% |

||

|

DPMs* |

-- |

0.02% |

-- |

0.02% |

-- |

-- |

||

|

Total (GCC investors) |

0.49% |

2.48% |

0.49% |

2.49% |

-- |

0.01% |

||

|

Foreign Investors |

SWAP Holders |

0.02% |

0.16% |

0.02% |

0.16% |

-- |

-- |

|

|

Foreign Resident |

0.09% |

0.49% |

0.07% |

0.36% |

(0.02%) |

(0.14%) |

||

|

QFIs |

1.71% |

12.15% |

1.70% |

12.11% |

(0.01%) |

(0.04%) |

||

|

DPMs* |

0.01% |

0.08% |

0.01% |

0.07% |

-- |

(0.01%) |

||

|

Strategic Partners |

0.44% |

-- |

0.43% |

-- |

-- |

-- |

||

|

Total (foreign investors) |

2.27% |

12.88% |

2.24% |

12.70% |

(0.03%) |

(0.18%) |

||

|

Ownership’s Value & Ratio by Investor Type (SAR bln) |

|||||||

|

Investor Type |

November 26 |

December 3 |

Change in Ownership |

||||

|

Equity |

Issued Shares |

Free Float |

Equity |

Issued Shares |

Free Float |

||

|

Institutional |

8949.0 |

96.54% |

75.66% |

8936.7 |

96.55% |

75.68% |

(12.3) |

|

Non- Institutional |

319.0 |

3.46 % |

24.34 % |

317.8 |

3.45 % |

24.32 % |

(1.2) |

|

Total |

9268.0 |

100% |

100% |

9254.5 |

100% |

100% |

(13.5) |

Comments {{getCommentCount()}}

Be the first to comment

رد{{comment.DisplayName}} على {{getCommenterName(comment.ParentThreadID)}}

{{comment.DisplayName}}

{{comment.ElapsedTime}}