Saudi Manpower Solutions Co. announces its Interim Financial results for the Period Ending on 2025-09-30 ( Nine Months )

| Element List | Current Period | Similar period for previous year | %Change |

|---|---|---|---|

| Sales/Revenue | 1,546 | 1,417.3 | 9.08 |

| Gross Profit (Loss) | 217.97 | 163.39 | 33.404 |

| Operational Profit (Loss) | 129.47 | 106.57 | 21.488 |

| Net profit (Loss) | 110.62 | 103.09 | 7.304 |

| Total Comprehensive Income | 102.57 | 106.29 | -3.499 |

| Total Shareholders Equity (after Deducting Minority Equity) | 602.92 | 600.35 | 0.428 |

| Profit (Loss) per Share | 0.277 | 0.258 | |

| All figures are in (Millions) Saudi Arabia, Riyals | |||

| Element List | Amount | Percentage of the capital (%) | |

|---|---|---|---|

| Profit (Losses) Resulting From The Change In Investment Propertie’s Fair Value | - | - | |

| All figures are in (Millions) Saudi Arabia, Riyals | |||

| Element List | Explanation |

|---|---|

| The reason of the increase (decrease) in the sales/ revenues during the current quarter compared to the same quarter of the last year is |

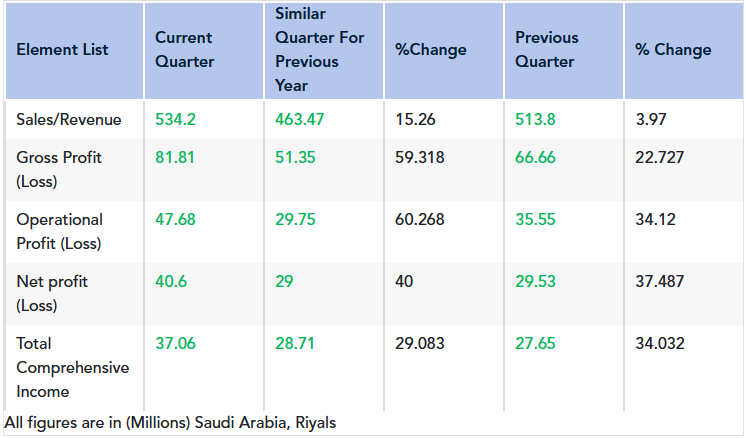

During the third quarter of 2025, the Company’s consolidated revenues increased by SAR 70 million, representing a growth of 15% compared to the corresponding quarter of the previous year.

This improvement was primarily driven by higher revenues across the Company’s main segments, Corporate and Individuals Segments, which recorded growth rates of 15% and 18%, respectively. The increase was mainly attributable to stronger demand for the services offered within these segments. Meanwhile, revenues from the Other Services Segment remained broadly in line with those reported in the corresponding quarter of the previous year. |

| The reason of the increase (decrease) in the net profit during the current quarter compared to the same quarter of the last year is |

The Company’s consolidated net income for the third quarter of the current year increased by 40% compared to the third quarter of the previous year. This improvement is mainly attributable to the following factors:

• An increase in the Company’s revenues by 15% compared to the corresponding quarter of the previous year. • An increase in gross profit by SAR 30 million, representing a 59% rise compared to the corresponding quarter of the previous year. This improvement was driven by enhanced gross profit in the Company’s main segments — the Corporate Segment and the Individuals Segment — resulting from higher demand and the implementation of initiatives aimed at improving profitability in the Individuals Segment, particularly through optimizing portfolio diversification to better align with market needs. • A decrease in general and administrative expenses by SAR 1.4 million compared to the corresponding quarter of the previous year, which included the Company’s share of public offering expenses recorded after the listing on Tadawul. • An increase in selling and marketing expenses by SAR 1.9 million compared to the corresponding quarter of the previous year, due to higher sales and marketing activity. • Recognition of an expected credit loss provision of SAR 12 million, compared to the corresponding quarter of the previous year, in accordance with the expected credit loss model. • Recognition of investment losses amounting to SAR 4.4 million from Waad Khadmat Al Munzal for Marketing, in line with the business plan of the Company, which was launched in 2025. |

| The reason of the increase (decrease) in the sales/ revenues during the current quarter compared to the previous one is |

The Company’s consolidated revenues for the current quarter of 2025 increased by SAR 20 million, representing a growth of 4% compared to the previous quarter.

This increase was driven by improved revenues across the Company’s main business segments — the Corporate Segment and the Individuals Segment — which recorded growth rates of 3.6% and 3.1%, respectively, mainly due to higher demand for the services offered within these segments. In addition, revenues from the Other Services Segment increased by 6% compared to the previous quarter. |

| The reason of the increase (decrease) in the net profit (loss) during the current quarter compared to the previous one is |

The Company’s consolidated net income for the current quarter of 2025 increased by 37% compared to the previous quarter. This improvement is primarily attributable to the following factors:

• A 4% increase in the Company’s revenues compared to the previous quarter. • An increase in gross profit by SAR 15 million, representing a 22% rise compared to the previous quarter, driven by higher activity across the Company’s sectors — the Corporate Segment, the Individuals Segment, and Other Services. • An increase in selling and marketing expenses by approximately SAR 1 million compared to the previous quarter, due to higher sales and marketing activity. • An increase in provisions for the current quarter by approximately SAR 1.7 million compared to the previous quarter, related to doubtful receivables and advances to suppliers. • An increase in other income by approximately SAR 1.2 million compared to the previous quarter, mainly due to recognizing a loss related to the reallocation of certain activity centers amounting to approximately SAR 0.9 million in the previous quarter, as part of the regular periodic review and reallocation of activity centers. • An increase of approximately SAR 0.7 million in investment losses related to Waad Khadmat Al Munzal for Marketing compared to the previous quarter, resulting from higher expenses associated with launching the new brand. • An increase in the zakat expense provision by approximately SAR 1.5 million compared to the previous quarter. |

| The reason of the increase (decrease) in the sales/ revenues during the current period compared to the same period of the last year is | The Company’s consolidated revenues for the current period of 2025 increased by SAR 128 million, representing a 9% growth compared to the corresponding period of the previous year. This increase is primarily attributable to the improved performance of the Company’s main segments, the Corporate Segment and the Individuals Segment, which grew by 8.5% and 14%, respectively, driven by higher demand for the services offered within these segments. Meanwhile, revenues from the Other Services Segment declined by 2.4% compared to the corresponding period of the previous year, due to natural fluctuations in the activities associated with other services provided. |

| The reason of the increase (decrease) in the net profit during the current period compared to the same period of the last year is |

The Company’s consolidated net income for the current period increased by 7.3% compared to the corresponding period of the previous year. This improvement is primarily attributable to the following factors:

• A 9% increase in the Company’s revenues compared to the corresponding period of the previous year. • An increase in gross profit by SAR 54 million, representing a 33% rise compared to the corresponding period of the previous year, driven by improved gross profit in the Company’s main segments — the Corporate Segment and the Individuals Segment — resulting from higher demand and the implementation of initiatives aimed at enhancing profitability in the Individuals Segment, particularly through optimizing portfolio diversification to better align with market needs. • An increase in general and administrative expenses by approximately SAR 3.5 million compared to the corresponding period of the previous year, due to higher information technology and cybersecurity expenses and related subscriptions, increased consulting and professional service costs for enhancing internal processes, as well as higher building depreciation expenses. • An increase in selling and marketing expenses by approximately SAR 3.5 million compared to the corresponding period of the previous year, driven by increased sales and marketing activity. • Recognition of an expected credit loss provision of SAR 18.8 million compared to the corresponding period of the previous year, in accordance with the expected credit loss model. • Recognition of an impairment loss on advances to suppliers amounting to approximately SAR 5.9 million during the current period, which was not present in the corresponding period of the previous year. • A decrease in other income by approximately SAR 1.9 million compared to the corresponding period of the previous year, mainly due to the recognition of non-recurring income of approximately SAR 0.9 million in the previous period, and the recognition of a loss related to the closure of certain distribution centers amounting to approximately SAR 0.9 million, as part of the regular periodic review and reallocation of activity centers during the current period. • Recognition of investment losses amounting to SAR 11.9 million from Waad Khadmat Al Munzal for Marketing, in line with the Company’s business plan launched in 2025. • An increase in the zakat expense provision by approximately SAR 974 thousand compared to the corresponding period of the previous year. |

| Statement of the type of external auditor's report | Unmodified conclusion |

| Comment mentioned in the external auditor’s report, mentioned in any of the following paragraphs (other matter, conservation, notice, disclaimer of opinion, or adverse opinion) | NA |

| Reclassification of Comparison Items | Certain comparative figures have been reclassified and presented for the purpose of better presentation. However, the effect of those reclassifications was not significant. |

| Additional Information | - |

Comments {{getCommentCount()}}

Be the first to comment

رد{{comment.DisplayName}} على {{getCommenterName(comment.ParentThreadID)}}

{{comment.DisplayName}}

{{comment.ElapsedTime}}

Comments Analysis: