Tadawul trading screen

Saudi Arabia’s benchmark Tadawul All Share Index (TASI) witnessed a first in 2025, as some IPOs faced weak demand from individual investors and subscription rates fell sharply, particularly in the fourth quarter compared to the beginning of the year.

Retail investors covered approximately 70.9% of the shares allocated to them in the Consolidated Grunenfelder Saady Holding Co. (CGS) offering, while the lowest historical coverage came from Alramz Real Estate Co., with individuals subscribing to only 36% of the 2.57 million shares allocated to them.

Since the total shares allocated to individuals were not fully subscribed, the remaining shares were allocated to institutional investors, after which the companies’ shares were listed on TASI.

This level of retail shortfall has not been seen since 2019, when individual investors covered 60% of the Arabian Centres Co.’s (Cenomi Centers) IPO.

Meanwhile, EFSIM Facilities Management Co. recently announced the cancellation of its planned IPO after consultations with its financial advisor. The cancellation announcement came the day after the end of the institutional bookbuilding period in December of this year.

|

Not Fully Subscribed by Retail Investors IPOs |

||||||

|

Company Name |

Offer Price (SAR) |

Float Percentage |

Total Shares Offered |

Allocated o tIndividuals |

Individual Coverage (%) |

Share Performance from Offer Price |

|

CGS |

10 |

30% |

30 million shares (30% of total shares) |

6 million shares |

70.9% |

(11%) |

|

Alramz |

70 |

30% |

12.86 million shares (30% after capital hike) |

2.57 million shares |

36% |

(25%) |

|

EFSIM |

19-20 |

30% |

16.8 million shares |

5.04 million shares |

Planned IPO was cancelled after consultations with its financial advisor |

|

Nomu-Parallel Market witnessed the cancellation of five IPOs due to incomplete offerings: Alwazn Almithaly Co., Zahr Al Khuzama Aluminum Co. (Lavenco), Rawabi Marketing International Co. (RMI), Al Khaldi Logistics Co., Dom International Investment Co., and International Unions For Trade Co. (IUTC), which was scrapped even before its launch.

Additionally, three companies—Afaq Al Arabiya for Transportation & Storage Co., Qudra Communications and Information Technology Co., and Saad Hussain Bin Dajam Group—cancelled their IPOs after the expiry of the six-month period granted by the Capital Market Authority (CMA) to complete their offerings.

|

Canceled IPOs on Nomu in 2025 |

|||

|

Company |

CMA Approval Date |

Cancellation Date |

Reason for Cancellation |

|

Alwazn Almithaly |

23/6/2025 |

Dec. 11 |

Offering not completed |

|

Lavenco |

18/6/2025 |

Nov. 26 |

Offering not completed |

|

Rawabi Marketing |

20/3/2025 |

Sep. 8 |

Offering not completed |

|

Al Khaldi Logistics |

23/12/2024 |

June 3 |

Offering not completed |

|

Dome |

20/3/2025 |

June 3 |

Offering not completed |

|

IUTC |

28/10/2024 |

Jan. 30 |

Company requested cancellation |

|

Afaq Al Arabiya |

20/3/2025 |

Oct. 20 |

Six-month period by the CMA to complete offerings expired |

|

Qudra Communications |

17/3/2025 |

Oct. 17 |

Six-month period by the CMA to complete offerings expired |

|

Saad Hussain Group |

9/12/2024 |

June 9 |

Six-month period by the CMA to complete offerings expired |

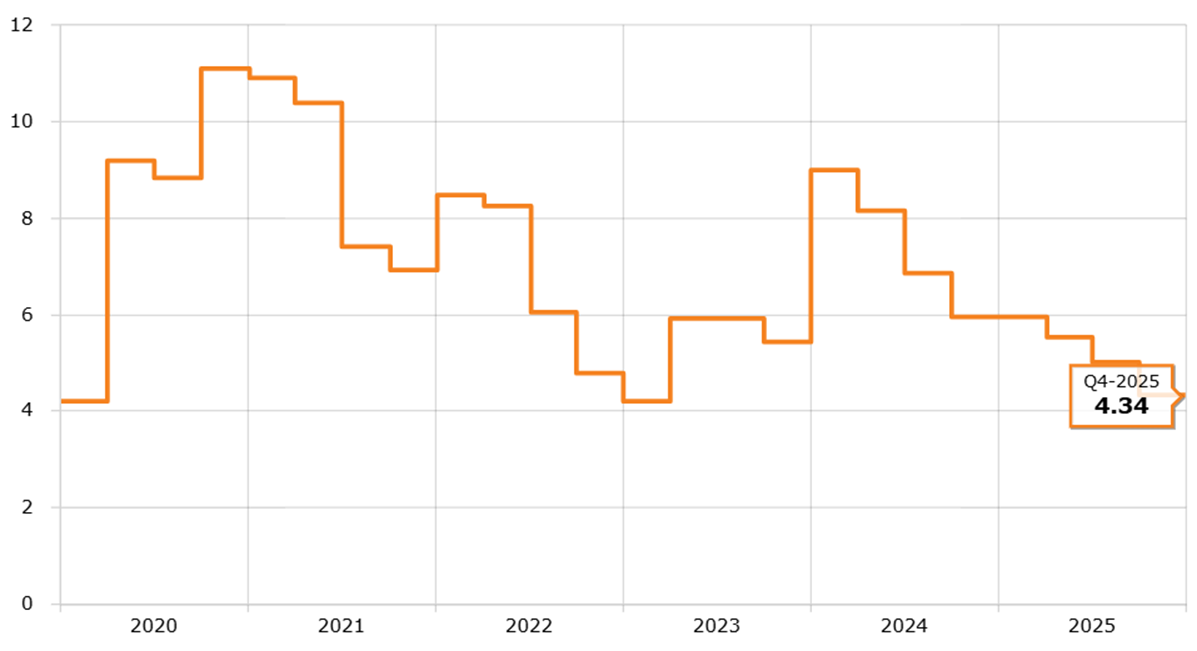

The decline in retail subscription coverage and the cancellation of some IPOs due to under-subscription coincided with a 14% drop in the Saudi market during 2025. This was also accompanied by low trading volumes, which contributed to weaker investor appetite for new offerings, amid multiple investment opportunities in previously listed companies, as illustrated in the chart below:

Quarterly Adj. Traded Volume (SAR bln)

Performance of listed companies during 2025:

Statistics and subscription analyses by Argaam show that only four companies on the Main Market delivered positive returns to investors by year-end, while 11 companies posted varying losses, with some losing up to half of their market value.

Leading the decliners was Nice One Beauty Digital Marketing Co., which listed in December 2024, as it dropped approximately 49.9%. It was followed by United Carton Industries Co. (UCIC) with a 49.6% loss, and Agricultural and Industrial Investments Co. (Entaj) that declined by 39%.

|

Performance of Companies-Listed in TASI in 2025 |

|||||||

|

Company |

Listing Date |

Shares Offered (mln) |

Institutional Coverage (x) |

Retail Coverage (%) |

Offering Price (SAR) |

Closing Price on Dec 30 (SAR) |

Change (%) |

|

Nice One* |

Jan. 8 |

34.65 |

139.4 |

750% |

35 |

17.53 |

(50%) |

|

UCIC |

May 27 |

12 |

126 |

890% |

50 |

25.22 |

(50%) |

|

Entaj |

March 17 |

9 |

208.4 |

3020% |

50 |

30.30 |

(39%) |

|

Build Station |

Sep. 2 |

4.8 |

9.67 |

200% |

85 |

52.75 |

(38%) |

|

Al Majdiah |

Sep. 10 |

90 |

107 |

278% |

14 |

9.82 |

(30%) |

|

SMC |

June 25 |

75 |

64.7 |

145% |

25 |

18.05 |

(28%) |

|

Alramz |

Dec. 18 |

12.86 |

11.1 |

36% |

70 |

52.55 |

(25%) |

|

flynas |

June 18 |

51.26 |

100 |

350% |

80 |

62.90 |

(21%) |

|

Derayah |

March 10 |

49.95 |

162 |

1510% |

30 |

25.00 |

(17%) |

|

Cherry Trading |

Dec. 1 |

9 |

85.6 |

647% |

28 |

23.72 |

(15%) |

|

CGS |

Dec. 9 |

30 |

61.6 |

71% |

10 |

8.87 |

(11%) |

|

Almoosa Health* |

Jan. 7 |

13.29 |

103 |

409% |

127 |

175.00 |

+38% |

|

Almasar Alshamil |

Dec. 2 |

30.72 |

102.9 |

121% |

19.5 |

24.65 |

+26% |

|

Masar |

March 24 |

130.79 |

241 |

2000% |

15 |

17.03 |

+14% |

|

Sports Clubs |

July 22 |

34.32 |

44.1 |

534% |

7.5 |

7.98 |

+6% |

*The offering took place in Dec. 2024 and was listed in 2025.

As for Nomu, 16 companies recorded a decline in performance from their IPO prices. Leading the losses was Shmoh Almadi Co., which was listed at the end of 2024, falling approximately 59.8% to close the year at SAR 8.85, followed by Service Equipment Co., down about 59.5% to SAR 34.

Conversely, six companies saw their share prices rise since listing, supported by increased demand and improved operational performance, while the shares of three companies remained at breakeven levels.

|

Performance of Companies-Listed in Nomu in 2025 |

||||||

|

Company |

Listing Date |

Shares Offered (mln) |

Coverage (%) |

Offering Price (SAR) |

Closing Price on Dec 30 (SAR) |

Change (%) |

|

Shmouh Almadi* |

Jan. 13 |

1.4 |

195% |

22 |

8.85 |

(60%) |

|

Service Equipment |

May. 4 |

0.72 |

147% |

84 |

34.00 |

(60%) |

|

Naf |

Jul. 20 |

0.4 |

111% |

76 |

40.20 |

(47%) |

|

Dkhoun |

May 20 |

0.4 |

119% |

121 |

65.00 |

(46%) |

|

Hamad Bin Saedan |

Sep. 16 |

4.24 |

114% |

13.5 |

7.83 |

(42%) |

|

Time Entertainment |

June 17 |

0.2 |

141% |

80 |

46.60 |

(42%) |

|

Hedab Alkhaleej |

March 5 |

0.8 |

173% |

52 |

30.48 |

(41%) |

|

Al Kuzama |

June 2 |

0.42 |

108% |

107 |

63.00 |

(41%) |

|

Alshehili |

Jan. 29 |

0.5 |

232% |

80 |

52.00 |

(35%) |

|

RATIO |

March 9 |

5 |

865% |

10 |

7.00 |

(30%) |

|

Altwijri Trading |

Nov. 20 |

1 |

122% |

25 |

20.80 |

(17%) |

|

Anmat |

June 11 |

5 |

286% |

9.5 |

8.02 |

(16%) |

|

Lamasat |

Feb. 9 |

6 |

1101% |

5.75 |

4.98 |

(13%) |

|

Sahat Almajd |

Nov. 5 |

4.38 |

110% |

7 |

6.40 |

(9%) |

|

Axelerated Solutions |

June 1 |

3 |

208% |

27 |

25.04 |

(7%) |

|

Wajd Life |

Sep. 15 |

2.5 |

179% |

5.7 |

5.57 |

(2%) |

|

Sign World |

Sep. 3 |

1.5 |

109% |

12 |

12.00 |

-- |

|

Jamjoom Fashion |

Sep. 18 |

2.38 |

450% |

145 |

144.60 |

-- |

|

Hawiya Auctions |

June 22 |

2.4 |

311% |

13 |

12.98 |

-- |

|

Adeer |

May 26 |

1 |

680% |

85 |

122.00 |

+44% |

|

Smile Care |

Feb. 3 |

4 |

1981% |

4.4 |

5.39 |

+23% |

|

Itmam |

Jan. 23 |

3 |

230% |

15 |

16.70 |

+11% |

|

Asas Makeen |

June 16 |

1 |

1949% |

80 |

84.00 |

+5% |

|

Future Vision |

April 27 |

2 |

513% |

7 |

7.20 |

+3% |

|

Twareat** |

Jan. 29 |

_ |

_ |

12 |

12.20 |

+2% |

|

KDL Logistics |

Unannounced |

0.7 |

102% |

23 |

-- |

-- |

*The offering took place in Dec. 2024 and was listed in 2025.

**Direct listing.

The total proceeds from IPOs reached SAR 14.5 billion in 2025, compared with SAR 14.2 billion last year. Meanwhile, the total number of shares offered amounted to approximately 540 million during the year, up from around 532 million shares in 2024.

Be the first to comment

Comments Analysis: