Search Result

- TASI

-

Energy

- 2222 - SAUDI ARAMCO

- 2030 - SARCO

- 2380 - PETRO RABIGH

- 4030 - BAHRI

- 2381 - ARABIAN DRILLING

- 2382 - ADES

- 1201 - TAKWEEN

- 1202 - MEPCO

- 1210 - BCI

- 1211 - MAADEN

- 1301 - ASLAK

- 1304 - ALYAMAMAH STEEL

- 1320 - SSP

- 2001 - CHEMANOL

- 2010 - SABIC

- 2020 - SABIC AGRI-NUTRIENTS

- 2090 - NGC

- 2150 - ZOUJAJ

- 2170 - ALUJAIN

- 2180 - FIPCO

- 2200 - APC

- 2210 - NAMA CHEMICALS

- 2220 - MAADANIYAH

- 2240 - SENAAT

- 2250 - SIIG

- 2290 - YANSAB

- 2300 - SPM

- 2310 - SIPCHEM

- 2330 - ADVANCED

- 2350 - SAUDI KAYAN

- 3002 - NAJRAN CEMENT

- 3003 - CITY CEMENT

- 3004 - NORTHERN CEMENT

- 3005 - UACC

- 3010 - ACC

- 3020 - YC

- 3030 - SAUDI CEMENT

- 3040 - QACCO

- 3050 - SPCC

- 3060 - YCC

- 3080 - EPCCO

- 3090 - TCC

- 3091 - JOUF CEMENT

- 3092 - RIYADH CEMENT

- 2060 - TASNEE

- 3008 - ALKATHIRI

- 3007 - OASIS

- 1321 - EAST PIPES

- 1322 - AMAK

- 2223 - LUBEREF

- 2360 - SVCP

- 1323 - UCIC

- 4143 - TALCO

- 1212 - ASTRA INDUSTRIAL

- 1302 - BAWAN

- 4146 - GAS

- 1303 - EIC

- 4145 - OBEIKAN GLASS

- 4148 - ALWASAIL INDUSTRIAL

- 2040 - SAUDI CERAMICS

- 2110 - SAUDI CABLE

- 4144 - RAOOM

- 2160 - AMIANTIT

- 2320 - ALBABTAIN

- 2370 - MESC

- 4140 - SIECO

- 4141 - ALOMRAN

- 4142 - RIYADH CABLES

- 1214 - SHAKER

- 4110 - BATIC

- 4147 - CGS

- 4031 - SGS

- 4040 - SAPTCO

- 4260 - BUDGET SAUDI

- 2190 - SISCO HOLDING

- 4261 - THEEB

- 4263 - SAL

- 4262 - LUMI

- 4265 - CHERRY

- 4264 - FLYNAS

- 1810 - SEERA

- 6013 - DWF

- 1820 - BAAN

- 4170 - TECO

- 4290 - ALKHALEEJ TRNG

- 6017 - JAHEZ

- 6002 - HERFY FOODS

- 1830 - LEEJAM SPORTS

- 6012 - RAYDAN

- 4291 - NCLE

- 4292 - ATAA

- 6014 - ALAMAR

- 6015 - AMERICANA

- 6016 - BURGERIZZR

- 6018 - SPORT CLUBS

- 6019 - ALMASAR ALSHAMIL

- 4003 - EXTRA

- 4008 - SACO

- 4050 - SASCO

- 4190 - JARIR

- 4240 - CENOMI RETAIL

- 4191 - ABO MOATI

- 4051 - BAAZEEM

- 4192 - ALSAIF GALLERY

- 4193 - NICE ONE

- 4194 - BUILD STATION

- 4200 - ALDREES

- 4001 - A.OTHAIM MARKET

- 4006 - FARM SUPERSTORES

- 4061 - ANAAM HOLDING

- 4160 - THIMAR

- 4161 - BINDAWOOD

- 4162 - ALMUNAJEM

- 4164 - NAHDI

- 4163 - ALDAWAA

- 2050 - SAVOLA GROUP

- 2100 - WAFRAH

- 2270 - SADAFCO

- 2280 - ALMARAI

- 6001 - HB

- 6010 - NADEC

- 2288 - NOFOTH

- 6020 - GACO

- 6040 - TADCO

- 6050 - SFICO

- 6060 - SHARQIYAH DEV

- 6070 - ALJOUF

- 6090 - JAZADCO

- 2281 - TANMIAH

- 2282 - NAQI

- 2283 - FIRST MILLS

- 4080 - SINAD HOLDING

- 2284 - MODERN MILLS

- 2285 - ARABIAN MILLS

- 2286 - FOURTH MILLING

- 2287 - ENTAJ

- 4002 - MOUWASAT

- 4021 - CMCER

- 4004 - DALLAH HEALTH

- 4005 - CARE

- 4007 - ALHAMMADI

- 4009 - SAUDI GERMAN HEALTH

- 2230 - CHEMICAL

- 4013 - SULAIMAN ALHABIB

- 2140 - AYYAN

- 4014 - EQUIPMENT HOUSE

- 4017 - FAKEEH CARE

- 4018 - ALMOOSA

- 4019 - SMC HEALTHCARE

- 1010 - RIBL

- 1020 - BJAZ

- 1030 - SAIB

- 1050 - BSF

- 1060 - SAB

- 1080 - ANB

- 1120 - ALRAJHI

- 1140 - ALBILAD

- 1150 - ALINMA

- 1180 - SNB

- 2120 - SAIC

- 4280 - KINGDOM

- 4130 - SAUDI DARB

- 4081 - NAYIFAT

- 1111 - TADAWUL GROUP

- 4082 - MRNA

- 1182 - AMLAK

- 1183 - SHL

- 4083 - TASHEEL

- 4084 - DERAYAH

- 8010 - TAWUNIYA

- 8012 - JAZIRA TAKAFUL

- 8020 - MALATH INSURANCE

- 8030 - MEDGULF

- 8040 - MUTAKAMELA

- 8050 - SALAMA

- 8060 - WALAA

- 8070 - ARABIAN SHIELD

- 8190 - UCA

- 8230 - ALRAJHI TAKAFUL

- 8280 - LIVA

- 8150 - ACIG

- 8210 - BUPA ARABIA

- 8180 - ALSAGR INSURANCE

- 8170 - ALETIHAD

- 8100 - SAICO

- 8120 - GULF UNION ALAHLIA

- 8200 - SAUDI RE

- 8160 - AICC

- 8250 - GIG

- 8240 - CHUBB

- 8260 - GULF GENERAL

- 8300 - WATANIYA

- 8310 - AMANA INSURANCE

- 8311 - ENAYA

- 8313 - RASAN

- 4330 - RIYAD REIT

- 4331 - ALJAZIRA REIT

- 4332 - JADWA REIT ALHARAMAIN

- 4333 - TALEEM REIT

- 4334 - AL MAATHER REIT

- 4335 - MUSHARAKA REIT

- 4336 - MULKIA REIT

- 4338 - ALAHLI REIT 1

- 4337 - Al AZIZIAH REIT

- 4342 - JADWA REIT SAUDI

- 4340 - Al RAJHI REIT

- 4339 - DERAYAH REIT

- 4344 - SEDCO CAPITAL REIT

- 4347 - BONYAN REIT

- 4345 - ALINMA RETAIL REIT

- 4346 - MEFIC REIT

- 4348 - ALKHABEER REIT

- 4349 - ALINMA HOSPITALITY REIT

- 4350 - ALISTITHMAR REIT

- 4020 - ALAKARIA

- 4324 - BANAN

- 4323 - SUMOU

- 4090 - TAIBA

- 4100 - MCDC

- 4150 - ARDCO

- 4220 - EMAAR EC

- 4230 - RED SEA

- 4250 - JABAL OMAR

- 4300 - DAR ALARKAN

- 4310 - KEC

- 4320 - ALANDALUS

- 4321 - CENOMI CENTERS

- 4322 - RETAL

- 4326 - ALMAJDIAH

- 4325 - MASAR

- 4327 - AlRAMZ

- NOMU

-

Media and Entertainment

Consumer Durables & Apparel

Real Estate Mgmt & Dev't

- 9521 - INMAR

- 9535 - LADUN

- 9591 - VIEW

- 9610 - FIRST AVENUE

- 9634 - ADEER

- 9640 - ASAS MAKEEN

- 9648 - HAMAD BIN SAEDAN REAL ESTATE

- 9641 - HAWYIA

- 9515 - FESH FASH

- 9532 - ALJOUF WATER

- 9536 - FADECO

- 9559 - BALADY

- 9564 - HORIZON FOOD

- 9555 - LEEN ALKHAIR

- 9612 - SAMA WATER

- 9622 - SMC

- 9644 - NAF

- 9650 - SAHAT ALMAJD

- 9530 - TIBBIYAH

- 9527 - AME

- 9544 - FUTURE CARE

- 9546 - NABA ALSAHA

- 9574 - PRO MEDEX

- 9594 - ALMODAWAT

- 9572 - ALRAZI

- 9587 - LANA

- 9600 - QOMEL

- 9604 - MIRAL

- 9626 - SMILE CARE

- 9616 - JANA

- 9627 - TMC

- 9620 - BALSM MEDICAL

- 9647 - WAJD LIFE

- 9513 - WATANI STEEL

- 9514 - ALNAQOOL

- 9523 - GROUP FIVE

- 9539 - AQASEEM

- 9548 - APICO

- 9553 - MOLAN

- 9565 - MEYAR

- 9552 - SAUDI TOP

- 9563 - BENA

- 9566 - LIME INDUSTRIES

- 9580 - ALRASHID INDUSTRIAL

- 9576 - PAPER HOME

- 9588 - RIYADH STEEL

- 9575 - MARBLE DESIGN

- 9599 - TAQAT

- 9601 - ALRASHEED

- 9605 - NEFT ALSHARQ

- 9607 - ASG

- 9609 - NAAS PETROL

- 9623 - ALBATTAL FACTORY

- 9631 - HKC

- 9510 - NBM

- 9533 - SPC

- 9542 - KEIR

- 9547 - RAWASI

- 9568 - MAYAR

- 9569 - ALMUNEEF

- 9578 - ATLAS ELEVATORS

- 9560 - WAJA

- 9611 - UFG

- 9624 - ALSHEHILI METAL

- 9633 - SERVICE EQUIPMENT

- 9639 - ANMAT

- 9583 - UNITED MINING

- 9608 - ALASHGHAL ALMOYSRA

- 9540 - TADWEEER

- 9545 - ALDAWLIAH

- 9570 - TAM DEVELOPMENT

- 9593 - PAN GULF

- 9597 - LEAF

- 9606 - THARWAH

- 9613 - SHALFA

- 9619 - MULTI BUSINESS

- 9621 - DRC

- 9625 - ITMAM

- 9645 - SIGN WORLD

- 9541 - ACADEMY OF LEARNING

- 9562 - FOOD GATE

- 9590 - ARMAH

- 9598 - ALMOHAFAZA FOR EDUCATION

- 9603 - HORIZON EDUCATIONAL

- 9567 - GHIDA ALSULTAN

- 9617 - ARABICA STAR

- 9630 - RATIO

- 9628 - LAMASAT

- 9632 - FUTURE VISION

- 9636 - AlKUZAMA

- 9581 - CLEAN LIFE

- 9522 - ALHASOOB

- 9537 - AMWAJ INTERNATIONAL

- 9551 - KNOWLEDGE TOWER

- 9589 - FAD

- 9649 - JAMJOOM FASHION

- 9651 - ALTWIJRI

Sign In

×Forgot password?

×-

Bank Ranking Banks Ratios Cement Statistics Cement Ranking Cement Ratios Monetary and Economic Statistics Oil, Gas and Fuel Macro Economy Consumer Spending Inflation Exports & Imports Food Prices Non Food Prices Construction Materials Petrochem. Ranking Petrochem. Ratios Retail Rankings Retail Ratios Grocery Ranking Grocery Ratios Top Growth Dividend History

Argaam Tools

×

Argaam Tools

×

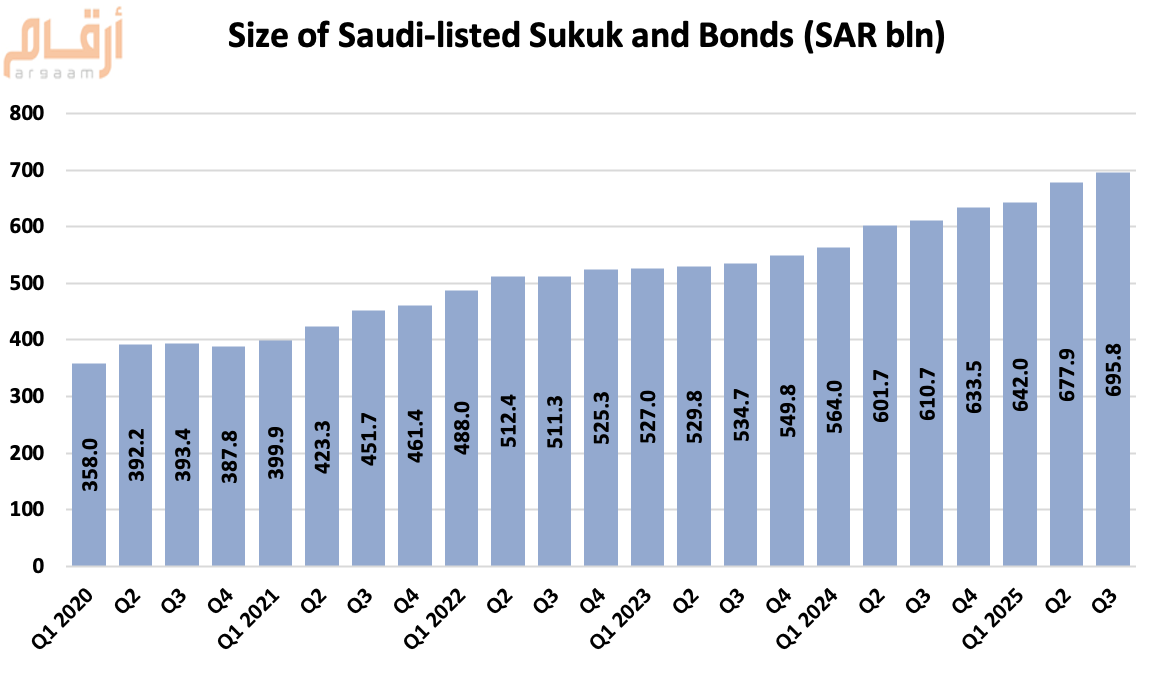

Saudi-listed sukuk/bonds reach SAR 695.8B in Q3 2025

The Kingdom of Saudi Arabia's flag

The total value of Saudi-listed sukuk and bonds rose to SAR 695.8 billion at the end of Q3 2025, up 3% quarter-on-quarter (QoQ), according to Tadawul’s quarterly debt market report.

Traded value dropped 89% to SAR 1.78 billion from SAR 16 billion in Q2.

Executed trades totaled 10,414, compared to 12,251 in Q2.

The number of listed sukuk/bond issuances stood at 60, down from 61 in Q2 2025.

Listed sukuk/bonds as a share of GDP edged up to 18.4% from 18.2% in Q2 2025.

|

Listed Sukuk/Bond Size |

|||

|

Period |

Value (SAR bln) |

QoQ Change (SAR bln) |

QoQ Change |

|

Q1 2020 |

358.0 |

-- |

-- |

|

Q2 |

392.2 |

+ 34.2 |

+10% |

|

Q3 |

393.4 |

+ 1.2 |

+0.3% |

|

Q4 |

387.8 |

(5.6) |

(1%) |

|

Q1 2021 |

399.9 |

+ 12.1 |

+3% |

|

Q2 |

423.3 |

+ 23.3 |

+6% |

|

Q3 |

451.7 |

+ 28.5 |

+7% |

|

Q4 |

461.4 |

+ 9.7 |

+2% |

|

Q1 2022 |

488.0 |

+ 26.6 |

+6% |

|

Q2 |

512.4 |

+ 24.4 |

+5% |

|

Q3 |

511.3 |

(1.1) |

(0.2%) |

|

Q4 |

525.3 |

+ 14.1 |

+3% |

|

Q1 2023 |

527.0 |

+ 1.6 |

+0.3% |

|

Q2 |

529.8 |

+ 2.8 |

+1% |

|

Q3 |

534.7 |

+ 5.0 |

+1% |

|

Q4 |

549.8 |

+ 15.1 |

+3% |

|

Q1 2024 |

564.0 |

+ 14.2 |

+3% |

|

Q2 |

601.7 |

+ 37.7 |

+7% |

|

Q3 |

610.7 |

+ 9.0 |

+1% |

|

Q4 |

633.5 |

+ 22.8 |

+4% |

|

Q1 2025 |

642.0 |

+ 8.5 |

+1% |

|

Q2 |

677.9 |

+ 35.9 |

+6% |

|

Q3 |

695.8 |

+ 17.9 |

+3% |

Government sukuk and bonds accounted for 97.6% of total listed debt at end-period, reaching SAR 679.1 billion.

Corporate sukuk and bonds made up the remaining 2.4%, or SAR 16.7 billion.

|

Details of Listed Sukuk/Bonds: |

||||

|

Period |

Govt Sukuk & Bonds |

Corporate Sukuk & Bonds |

||

|

Value (SAR bln) |

% of Total |

Value (SAR bln) |

% of Total |

|

|

Q1 2020 |

334.9 |

93.5 % |

23.1 |

% 6.5 |

|

Q2 |

369.6 |

94.2 % |

22.6 |

% 5.8 |

|

Q3 |

370.8 |

94.2 % |

22.6 |

% 5.8 |

|

Q4 |

365.7 |

94.3 % |

22.1 |

% 5.7 |

|

Q1 2021 |

377.8 |

4.5 % |

22.1 |

% 5.5 |

|

Q2 |

401.3 |

94.8 % |

22.0 |

% 5.2 |

|

Q3 |

429.7 |

95.1 % |

22.0 |

% 4.9 |

|

Q4 |

439.8 |

95.3 % |

21.6 |

% 4.7 |

|

Q1 2022 |

466.4 |

95.6 % |

21.6 |

% 4.4 |

|

Q2 |

496.8 |

97.0 % |

15.6 |

% 3.0 |

|

Q3 |

499.6 |

97.7 % |

11.7 |

% 2.3 |

|

Q4 |

503.9 |

95.9 % |

21.4 |

% 4.1 |

|

Q1 2023 |

505.6 |

95.9 % |

21.4 |

% 4.1 |

|

Q2 |

509.7 |

96.2 % |

20.0 |

3.8 % |

|

Q3 |

514.7 |

96.3 % |

20.0 |

3.7 % |

|

Q4 |

529.8 |

96.4 % |

20.0 |

3.6 % |

|

Q1 2024 |

547.4 |

97.1 % |

16.5 |

2.9 % |

|

Q2 |

585.2 |

97.2 % |

16.5 |

2.7 % |

|

Q3 |

594.2 |

97.3 % |

16.5 |

2.7 % |

|

Q4 |

617.0 |

97.4 % |

16.5 |

2.6 % |

|

Q1 2025 |

625.4 |

97.4 % |

16.6 |

2.6 % |

|

Q2 |

661.2 |

97.5 % |

16.7 |

2.5 % |

|

Q3 |

679.1 |

97.6 % |

16.7 |

2.4 % |

Saudi holdings of listed debt instruments totaled SAR 677.4 billion at the end of Q3 2025, representing 97.4% of the total.

On the other hand, foreign investors held about SAR 15 billion, while GCC investors owned SAR 3.4 billion.

|

Holdings by Nationality |

||

|

Nationality |

Value (SAR bln) |

% of Total |

|

Saudis |

677.39 |

97.4 % |

|

Foreign Investors |

15.01 |

2.2 % |

|

GCC Investors |

3.36 |

0.5 % |

|

Total |

695.76 |

100 % |

Comments {{getCommentCount()}}

Be the first to comment

رد{{comment.DisplayName}} على {{getCommenterName(comment.ParentThreadID)}}

{{comment.DisplayName}}

{{comment.ElapsedTime}}

Most Read

- CATRION inks SAR 23.1M catering deal with Saudia

- First Avenue inks SAR 27.4M infrastructure development contract in Riyadh

- The Arab Energy Fund and SOFAZ acquire stake in PAL Cooling Holding

- East Pipes: Strong operating demand; deposits and investments make up 3% of net profit

- Alinma Bank recommends 1-for-5 bonus issue

Market Indices

Popular Links

Quick Links

About Us

Join Us

Argaam Investment Company has updated the Privacy Policy of its services and digital platforms. Know more about our Privacy Policy here.

Argaam uses cookies to personalize content, to provide social media features and analyze traffic, that we might also share with third parties. You consent to our cookies if you use this website

Comments Analysis: