Maharah Human Resources Co. announces its Interim Financial results for the Period Ending on 2025-09-30 ( Nine Months )

| Element List | Current Period | Similar period for previous year | %Change |

|---|---|---|---|

| Sales/Revenue | 2,255.93 | 1,614.03 | 39.77 |

| Gross Profit (Loss) | 228.27 | 197.39 | 15.644 |

| Operational Profit (Loss) | 145.18 | 117.44 | 23.62 |

| Net profit (Loss) | 133.31 | 124.14 | 7.386 |

| Total Comprehensive Income | 124.71 | 122.56 | 1.754 |

| Total Shareholders Equity (after Deducting Minority Equity) | 738.26 | 621.3 | 18.825 |

| Profit (Loss) per Share | 0.3 | 0.28 | |

| All figures are in (Millions) Saudi Arabia, Riyals | |||

| Element List | Amount | Percentage of the capital (%) | |

|---|---|---|---|

| Profit (Losses) Resulting From The Change In Investment Propertie’s Fair Value | - | - | |

| Accumulated Losses | - | - | |

| All figures are in (Millions) Saudi Arabia, Riyals | |||

| Element List | Explanation |

|---|---|

| The reason of the increase (decrease) in the sales/ revenues during the current quarter compared to the same quarter of the last year is |

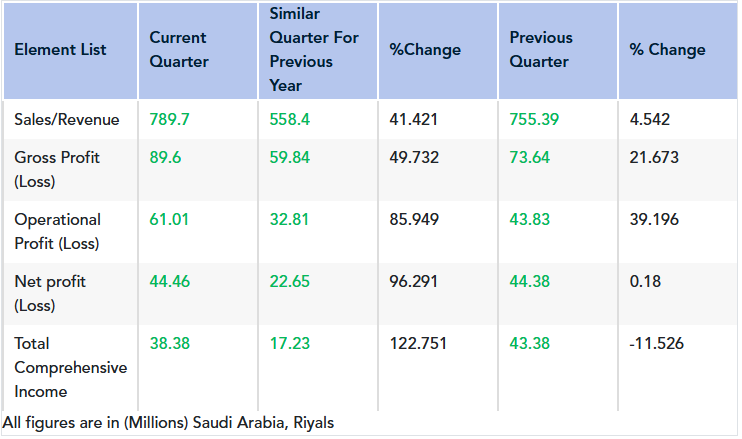

Consolidated revenues increased by SAR 231 million, with an increase of 41%, during the third quarter of the current year compared to the same quarter of last year, primarily due to:

• The overall increase in the main sector’s revenues, including the corporate services sector and individual services sector as follows:

• The corporate services sector revenues increased by 51% compared to the same quarter of last year, due to the increase in average number of workforces in this sector by 46% to match the rising demand of services offered by this sector and due to the strategic contracts achieved with clients.

• The individual services sector revenues also increased by 19% compared to the same quarter of last year, due to the increase in average number of workforces in this sector by 11% to match the rising demand for services offered in this sector and further supported by higher utilization and enhanced operational efficiency. |

| The reason of the increase (decrease) in the net profit during the current quarter compared to the same quarter of the last year is |

Consolidated net profit attributable to the Company’s shareholders increased by SAR 21.8 million, with an increase of 96%, for the third quarter of the current year compared to the same quarter of last year, mainly due to:

• The increase of 41% in the Company’s revenues for the third quarter of the current year compared to the same quarter of last year.

• The gross profit achieved of SAR 89.6 million for the third quarter of the current year, with an increase of SAR 29.8 million and a percentage increase of 49.7% compared to the same quarter of last year, driven by stronger performance across the Company’s main sectors—particularly the corporate services sector—together with a significant improvement in gross margins in the individual services sector during the current quarter, due to higher utilization achieved, enhanced operational efficiency and cost rationalization as a result of the improvement initiatives implemented in this sector during the year.

• The operating profit reached SAR 61 million for the third quarter of the current year, with an increase of SAR 28 million and a percentage increase of 86% compared to the same quarter of last year, primarily reflecting the higher gross profit achieved during this quarter. This was further supported by a SAR 2.9 million reduction in expected credit loss (ECL) expense compared to the same quarter of last year, according to the expected credit loss model, driven by improved collections during the period.

• This improvement in net profit for the quarter was achieved despite:

• Gross profit margins in the corporate services sector were affected during this quarter compared to the same quarter of last year —despite achieving higher revenues— to retain strategic customers and sustain the continuous growth in revenues and average number of workforces.

• An increase in general and administrative expenses of SAR 2.4 million, mainly due to investment in human capital through incentive schemes, training programs and talent acquisition.

• An increase in sales and marketing expenses by SAR 1.6 million, to support revenue growth.

• The decrease in the company's share of profits from associates (Saudi Medical Systems Company and Care Shield Holding) which amounted to SAR 5.8 million compared to the same quarter last year. This was mainly due to the decline in profits from Care Shield Holding during the current quarter compared to the same quarter of the last year. |

| The reason of the increase (decrease) in the sales/ revenues during the current quarter compared to the previous one is |

Consolidated revenues increased by SAR 34.3 million, with an increase of 4.5%, in the third quarter of the current year compared to the previous quarter, primarily due to:

• The overall increase in the main sector’s revenues, including the corporate services sector and individual services sector. The corporate services sector revenues grew by 4% in the current quarter compared to the previous quarter, driven by a continued increase in the average number of workforces in this sector. The individual services sector revenues also increased by 10% in the current quarter compared to the previous quarter, supported by higher utilization and enhanced operational efficiency in this sector. |

| The reason of the increase (decrease) in the net profit (loss) during the current quarter compared to the previous one is |

The Company reported consolidated net profit attributable to shareholders of approximately SAR 44 million for the third quarter, approximately in line with the previous quarter’s results, driven by:

• The increase of 4.5% in the Company’s revenues compared to the previous quarter.

• The gross profit achieved of SAR 89.6 million for the current quarter, with an increase of SAR 16 million and a percentage increase of 22% compared to the previous quarter, driven by stronger performance across the Company’s main sectors—particularly the individual services sector— where higher utilization and improved operating efficiency increased gross profit by SAR 11 million with an increase of 101% compared to the previous quarter.

• Operating profit increased by 39% in the current quarter compared to the previous quarter, driven mainly by stronger performance across the main sectors, despite the recognition of the gain on disposal in the previous quarter related to the sale of one of the unutilized accommodation facilities which increased the previous quarter’s results in comparison.

• The decrease in subsidiaries’ losses by SAR 6.5 million in this current quarter compared to the previous quarter, reflects ongoing improvement initiatives applied in line with the management action plans aimed at enhancing the performance of the subsidiaries.

In contrast

• The Company’s share of profits from associates. (Associates: Saudi Medical Systems Company and Care Shield Holding) decreased by SAR 16.5 million in the current quarter compared to the previous quarter. This was due to the none-recognition of the company’s share in results of Saudi Medical Systems Company for the three-month period ended 30 September 2025, as the Company was not able to obtain the interim financial results of the associate for the current quarter, In contrast, during the previous quarter,the Company recognized its share of profits from the associate results amounting to SAR 16.0 million. |

| The reason of the increase (decrease) in the sales/ revenues during the current period compared to the same period of the last year is |

The consolidated revenues increased by SAR 642 million, with an increase of 40%, during the nine-month period of the current year compared to the corresponding period of the previous year, primarily due to:

• Overall revenue growth across the main sectors, driven by the increase of 35% in the overall average number of workforces during the current period versus the corresponding period of the prior year, as follows:

• The corporate services sector revenues increased by 51% for the nine-month period of the current year compared to the corresponding period of the previous year, due to the increase in average number of workforces in this sector by 46% to match the rising demand of services offered by this sector and due to the strategic contracts achieved with clients.

• The individual services sector revenues increased by 14% for the nine-month period of the current year compared to the corresponding period of the previous year, due to the increase in average number of workforces in this sector by 11% to match the rising demand for services offered in this sector and further supported by higher utilization and enhanced operational efficiency. |

| The reason of the increase (decrease) in the net profit during the current period compared to the same period of the last year is |

The consolidated net profit attributed to the Company’s shareholders increased by 7.4% during the current period compared to the corresponding period of the previous year, due to:

• The increase of 40% in the Company’s revenues during the current period compared to the corresponding period of the previous year.

• The gross profit achieved of SAR 228 million for the current period, with an increase of SAR 30.9 million and a percentage increase of 16% compared to the corresponding period of the previous year , driven by stronger performance across the Company’s main sectors—particularly the corporate services sector—together with improvement in gross margins in the individual services sector during the current period, due to higher utilization achieved, enhanced operational efficiency and cost rationalization as a result of the improvement initiatives implemented in this sector during the year.

• The operating profit reached SAR 145 million for the current period, with an increase of SAR 27.7 million and a percentage increase of 24% compared to corresponding period of the previous year, primarily reflecting the higher gross profit achieved during this period. This was further supported by the following:

• A decrease of SAR 6.3 million in the provision for doubtful debts (expected credit loss – ECL) during the current period compared to the corresponding period of the previous year, according to the expected credit loss model, reflecting improved collections during the current period.

• An increase in other operating income by SAR 5.2 million during the current period compared to the corresponding period of the previous year, mainly due to the gain on disposal of an sale of one of the unutilized accommodation facilities during the period, in addition to employment support programs for Saudi nationals.

• This improvement in net profit for the current period was achieved despite:

• Gross profit margins in the corporate services sector were affected during the current period compared to the corresponding period of the previous year —despite achieving higher revenues— to retain strategic customers and sustain the continuous growth in revenues and average number of workforces.

• An increase in general and administrative expenses of SAR 7.5 million during the current period, mainly due to investment in human capital through incentive schemes, training programs and talent acquisition.

• An increase in sales and marketing expenses by SAR 2.0 million during the current period, to support revenue growth.

• Recognition of an impairment loss of SAR 5.1 million on other receivables during the current period (second quarter 2025), arising from the derecognition of Nabd Company

• The decrease in the company's share of profits from associates (Saudi Medical Systems Company and Care Shield Holding) which to SAR 16 million compared to the same quarter last year. This was mainly due to the decline in profits from Care Shield Holding during this period. It is worth to mention, that the Company obtained the interim financial statements of Saudi Medical Systems Company for the first six months of 2025 and recognized its share of profits from this associate amounting to SAR 36.7 million within the current period. |

| Statement of the type of external auditor's report | Conservation |

| Comment mentioned in the external auditor’s report, mentioned in any of the following paragraphs (other matter, conservation, notice, disclaimer of opinion, or adverse opinion) |

Basis for Qualified Conclusion

• The Group’s investment in its associate, ‘Saudi Medical Systems Company’, is stated at SAR 409,790,468 (31 December 2024: SAR 463,379,671) in the condensed consolidated statement of financial position as at 30 September 2025. During the three and nine-month periods ended 30 September 2025, and the three and nine-month periods ended 30 September 2024, the Group has not performed equity accounting for its investment in the associate in a manner required by IAS 28 ‘Investment in associate and joint ventures’. In the absence of the underlying information, it was impracticable for us to quantify the effects of this departure on the condensed consolidated interim financial statements.

• Further, as disclosed in Note (12), the Group has restated the statement of financial position as at 31 December 2024 to include the share of profit of this associate for the year ended 31 December 2024. However, we were not provided with access to the financial information, management, or auditor of Saudi Medical Systems Company. Accordingly, we were unable to perform review procedures regarding the adjustments applied to restate the carrying amount of the investment as at 31 December 2024. Consequently, we were unable to determine whether any adjustments in this condensed consolidated interim financial statements are necessary.

Qualified Conclusion

• Based on our review, except for the effects of the matter described in the first paragraph and the possible effects of the matter described in the second paragraph of the Basis for Qualified Conclusion, nothing has come to our attention that causes us to believe that the accompanying 30 September 2025 condensed consolidated interim financial statements of Maharah Human Resources Company (“Company”) and its subsidiaries (“Group”) are not prepared, in all material respects, in accordance with IAS 34, ‘Interim Financial Reporting’ that is endorsed in the Kingdom of Saudi Arabia. |

| Reclassification of Comparison Items | Certain prior period's figures have been reclassified to conform to the current period presentation. |

| Additional Information |

• The Company received the audited financial statements for the year ended 31 December 2024 of Saudi Medical Systems Company (associate), in which Growth Avenue Investment Company —a wholly owned subsidiary of Maharah Human Resources Company—holds a 40% stake. The Company’s share of the associate’s 2024 profits amounted to SAR 82.3 million, while the net share after the effects of the purchase price allocation (PPA) (amortization and depreciation) amounted to SAR 69.5 million. During the current period, the Company recognized its previously unrecorded share for the second half of 2024, totaling SAR 47.8 million, which had not been recognized in the 2024 consolidated financial statements due to the unavailability of the audited financial statements at that time. Accordingly, comparative figures as of year-end 2024 were adjusted for the equity-method for investments, retained earnings, and other reserves.

• The interim financial statements for Q1 and Q2 2025 of Saudi Medical Systems Company (associate) were received, and the Company recognized its share of results amounting to SAR 20.8 million for Q1 and SAR 15.9 million for Q2, bringing the total share to SAR 36.7 million for the period ended 30 June 2025.

• The Company was unable to recognize its share of results from Saudi Medical Systems Company for Q3 of both 2025 and 2024 due to the unavailability of the associate’s preliminary financial statements for those periods at the relevant time; and only recorded the effects of the purchase price allocation (PPA) (amortization and depreciation) were recognized in those quarters.

• The decision to liquidate Nabd Company (Logistics segment) was approved in Q2 2025. All operating activities ceased, and all derecognition/disposal costs were recorded, with these costs recognized within the consolidated statement of profit or loss and the consolidated statement of financial position in this period.

• The total comprehensive income attributable to the company’s shareholders as of September 30, 2025, amounted to SAR 124.7 million.

• Total equity attributable to the owners of the parent amounted to SAR 738 million as of 30 September 2025 (vs. SAR 673 million as of 31 December 2024, and SAR 621 million as of 30 September 2024)

• A conference call with analysts and investors will be announced later Details of the conference call will be available on Maharah’s website at the following link: https://www.maharah.com/investors |

Comments {{getCommentCount()}}

Be the first to comment

رد{{comment.DisplayName}} على {{getCommenterName(comment.ParentThreadID)}}

{{comment.DisplayName}}

{{comment.ElapsedTime}}

Comments Analysis: