Search Result

- TASI

-

Energy

- 2222 - SAUDI ARAMCO

- 2030 - SARCO

- 2380 - PETRO RABIGH

- 4030 - BAHRI

- 2381 - ARABIAN DRILLING

- 2382 - ADES

- 1201 - TAKWEEN

- 1202 - MEPCO

- 1210 - BCI

- 1211 - MAADEN

- 1301 - ASLAK

- 1304 - ALYAMAMAH STEEL

- 1320 - SSP

- 2001 - CHEMANOL

- 2010 - SABIC

- 2020 - SABIC AGRI-NUTRIENTS

- 2090 - NGC

- 2150 - ZOUJAJ

- 2170 - ALUJAIN

- 2180 - FIPCO

- 2200 - APC

- 2210 - NAMA CHEMICALS

- 2220 - MAADANIYAH

- 2240 - SENAAT

- 2250 - SIIG

- 2290 - YANSAB

- 2300 - SPM

- 2310 - SIPCHEM

- 2330 - ADVANCED

- 2350 - SAUDI KAYAN

- 3002 - NAJRAN CEMENT

- 3003 - CITY CEMENT

- 3004 - NORTHERN CEMENT

- 3005 - UACC

- 3010 - ACC

- 3020 - YC

- 3030 - SAUDI CEMENT

- 3040 - QACCO

- 3050 - SPCC

- 3060 - YCC

- 3080 - EPCCO

- 3090 - TCC

- 3091 - JOUF CEMENT

- 3092 - RIYADH CEMENT

- 2060 - TASNEE

- 3008 - ALKATHIRI

- 3007 - OASIS

- 1321 - EAST PIPES

- 1322 - AMAK

- 2223 - LUBEREF

- 2360 - SVCP

- 1323 - UCIC

- 4143 - TALCO

- 1212 - ASTRA INDUSTRIAL

- 1302 - BAWAN

- 4146 - GAS

- 1303 - EIC

- 4145 - OGC

- 4148 - ALWASAIL INDUSTRIAL

- 2040 - SAUDI CERAMICS

- 2110 - SAUDI CABLE

- 4144 - RAOOM

- 2160 - AMIANTIT

- 2320 - ALBABTAIN

- 2370 - MESC

- 4140 - SIECO

- 4141 - ALOMRAN

- 4142 - RIYADH CABLES

- 1214 - SHAKER

- 4110 - BATIC

- 4147 - CGS

- 4031 - SGS

- 4040 - SAPTCO

- 4260 - BUDGET SAUDI

- 2190 - SISCO HOLDING

- 4261 - THEEB

- 4263 - SAL

- 4262 - LUMI

- 4265 - CHERRY

- 4264 - FLYNAS

- 1810 - SEERA

- 6013 - DWF

- 1820 - BAAN

- 4170 - TECO

- 4290 - ALKHALEEJ TRNG

- 6017 - JAHEZ

- 6002 - HERFY FOODS

- 1830 - LEEJAM SPORTS

- 6012 - RAYDAN

- 4291 - NCLE

- 4292 - ATAA

- 6014 - ALAMAR

- 6015 - AMERICANA

- 6016 - BURGERIZZR

- 6018 - SPORT CLUBS

- 6019 - ALMASAR ALSHAMIL

- 4003 - EXTRA

- 4008 - SACO

- 4050 - SASCO

- 4190 - JARIR

- 4240 - CENOMI RETAIL

- 4191 - ABO MOATI

- 4051 - BAAZEEM

- 4192 - ALSAIF GALLERY

- 4193 - NICE ONE

- 4194 - BUILD STATION

- 4200 - ALDREES

- 4001 - A.OTHAIM MARKET

- 4006 - FARM SUPERSTORES

- 4061 - ANAAM HOLDING

- 4160 - THIMAR

- 4161 - BINDAWOOD

- 4162 - ALMUNAJEM

- 4164 - NAHDI

- 4163 - ALDAWAA

- 2050 - SAVOLA GROUP

- 2100 - WAFRAH

- 2270 - SADAFCO

- 2280 - ALMARAI

- 6001 - HB

- 2288 - NOFOTH

- 6010 - NADEC

- 6020 - GACO

- 6040 - TADCO

- 6050 - SFICO

- 6060 - SHARQIYAH DEV

- 6070 - ALJOUF

- 6090 - JAZADCO

- 2281 - TANMIAH

- 2282 - NAQI

- 2283 - FIRST MILLS

- 4080 - SINAD HOLDING

- 2284 - MODERN MILLS

- 2285 - ARABIAN MILLS

- 2286 - FOURTH MILLING

- 2287 - ENTAJ

- 4002 - MOUWASAT

- 4021 - CMCER

- 4004 - DALLAH HEALTH

- 4005 - CARE

- 4007 - ALHAMMADI

- 4009 - SAUDI GERMAN HEALTH

- 2230 - CHEMICAL

- 4013 - SULAIMAN ALHABIB

- 2140 - AYYAN

- 4014 - EQUIPMENT HOUSE

- 4017 - FAKEEH CARE

- 4018 - ALMOOSA

- 4019 - SMC HEALTHCARE

- 1010 - RIBL

- 1020 - BJAZ

- 1030 - SAIB

- 1050 - BSF

- 1060 - SAB

- 1080 - ANB

- 1120 - ALRAJHI

- 1140 - ALBILAD

- 1150 - ALINMA

- 1180 - SNB

- 2120 - SAIC

- 4280 - KINGDOM

- 4130 - SAUDI DARB

- 4081 - NAYIFAT

- 1111 - TADAWUL GROUP

- 4082 - MRNA

- 1182 - AMLAK

- 1183 - SHL

- 4083 - TASHEEL

- 4084 - DERAYAH

- 8010 - TAWUNIYA

- 8012 - JAZIRA TAKAFUL

- 8020 - MALATH INSURANCE

- 8030 - MEDGULF

- 8040 - MUTAKAMELA

- 8050 - SALAMA

- 8060 - WALAA

- 8070 - ARABIAN SHIELD

- 8190 - UCA

- 8230 - ALRAJHI TAKAFUL

- 8280 - LIVA

- 8150 - ACIG

- 8210 - BUPA ARABIA

- 8180 - ALSAGR INSURANCE

- 8170 - ALETIHAD

- 8100 - SAICO

- 8120 - GULF UNION ALAHLIA

- 8200 - SAUDI RE

- 8160 - AICC

- 8250 - GIG

- 8240 - CHUBB

- 8260 - GULF GENERAL

- 8300 - WATANIYA

- 8310 - AMANA INSURANCE

- 8311 - ENAYA

- 8313 - RASAN

- 4330 - RIYAD REIT

- 4331 - ALJAZIRA REIT

- 4332 - JADWA REIT ALHARAMAIN

- 4333 - TALEEM REIT

- 4334 - AL MAATHER REIT

- 4335 - MUSHARAKA REIT

- 4336 - MULKIA REIT

- 4338 - ALAHLI REIT 1

- 4337 - Al AZIZIAH REIT

- 4342 - JADWA REIT SAUDI

- 4340 - Al RAJHI REIT

- 4339 - DERAYAH REIT

- 4344 - SEDCO CAPITAL REIT

- 4347 - BONYAN REIT

- 4345 - ALINMA RETAIL REIT

- 4346 - MEFIC REIT

- 4348 - ALKHABEER REIT

- 4349 - ALINMA HOSPITALITY REIT

- 4350 - ALISTITHMAR REIT

- 4020 - ALAKARIA

- 4324 - BANAN

- 4323 - SUMOU

- 4090 - TAIBA

- 4100 - MCDC

- 4150 - ARDCO

- 4220 - EMAAR EC

- 4230 - RED SEA

- 4250 - JABAL OMAR

- 4300 - DAR ALARKAN

- 4310 - KEC

- 4320 - ALANDALUS

- 4321 - CENOMI CENTERS

- 4322 - RETAL

- 4326 - ALMAJDIAH

- 4325 - MASAR

- 4327 - AlRAMZ

- NOMU

-

Media and Entertainment

Consumer Durables & Apparel

Real Estate Mgmt & Dev't

- 9521 - INMAR

- 9535 - LADUN

- 9591 - VIEW

- 9610 - FIRST AVENUE

- 9634 - ADEER

- 9640 - ASAS MAKEEN

- 9648 - HAMAD BIN SAEDAN REAL ESTATE

- 9641 - HAWYIA

- 9515 - FESH FASH

- 9532 - ALJOUF WATER

- 9536 - FADECO

- 9559 - BALADY

- 9564 - HORIZON FOOD

- 9555 - LEEN ALKHAIR

- 9612 - SAMA WATER

- 9622 - SMC

- 9644 - NAF

- 9650 - SAHAT ALMAJD

- 9530 - TIBBIYAH

- 9527 - AME

- 9544 - FUTURE CARE

- 9546 - NABA ALSAHA

- 9574 - PRO MEDEX

- 9594 - ALMODAWAT

- 9572 - ALRAZI

- 9587 - LANA

- 9600 - QOMEL

- 9604 - MIRAL

- 9626 - SMILE CARE

- 9616 - JANA

- 9627 - TMC

- 9620 - BALSM MEDICAL

- 9647 - WAJD LIFE

- 9513 - WATANI STEEL

- 9514 - ALNAQOOL

- 9523 - GROUP FIVE

- 9539 - AQASEEM

- 9548 - APICO

- 9553 - MOLAN

- 9565 - MEYAR

- 9552 - SAUDI TOP

- 9563 - BENA

- 9566 - LIME INDUSTRIES

- 9580 - ALRASHID INDUSTRIAL

- 9576 - PAPER HOME

- 9588 - RIYADH STEEL

- 9575 - MARBLE DESIGN

- 9599 - TAQAT

- 9601 - ALRASHEED

- 9605 - NEFT ALSHARQ

- 9607 - ASG

- 9609 - NAAS PETROL

- 9623 - ALBATTAL FACTORY

- 9631 - HKC

- 9510 - NBM

- 9533 - SPC

- 9542 - KEIR

- 9547 - RAWASI

- 9568 - MAYAR

- 9569 - ALMUNEEF

- 9578 - ATLAS ELEVATORS

- 9560 - WAJA

- 9611 - UFG

- 9624 - ALSHEHILI METAL

- 9633 - SERVICE EQUIPMENT

- 9639 - ANMAT

- 9583 - UNITED MINING

- 9608 - ALASHGHAL ALMOYSRA

- 9540 - TADWEEER

- 9545 - ALDAWLIAH

- 9570 - TAM DEVELOPMENT

- 9593 - PAN GULF

- 9597 - LEAF

- 9606 - THARWAH

- 9613 - SHALFA

- 9619 - MULTI BUSINESS

- 9621 - DRC

- 9625 - ITMAM

- 9645 - SIGN WORLD

- 9541 - ACADEMY OF LEARNING

- 9562 - FOOD GATE

- 9590 - ARMAH

- 9598 - ALMOHAFAZA FOR EDUCATION

- 9603 - HORIZON EDUCATIONAL

- 9567 - GHIDA ALSULTAN

- 9617 - ARABICA STAR

- 9630 - RATIO

- 9628 - LAMASAT

- 9632 - FUTURE VISION

- 9636 - AlKUZAMA

- 9581 - CLEAN LIFE

- 9522 - ALHASOOB

- 9537 - AMWAJ INTERNATIONAL

- 9551 - KNOWLEDGE TOWER

- 9589 - FAD

- 9649 - JAMJOOM FASHION

- 9651 - ALTWIJRI

Sign In

×Forgot password?

×-

Bank Ranking Banks Ratios Cement Statistics Cement Ranking Cement Ratios Monetary and Economic Statistics Oil, Gas and Fuel Macro Economy Consumer Spending Inflation Exports & Imports Food Prices Non Food Prices Construction Materials Petrochem. Ranking Petrochem. Ratios Retail Rankings Retail Ratios Grocery Ranking Grocery Ratios Top Growth Dividend History

Argaam Tools

×

Argaam Tools

×

Deficit as a Growth Catalyst

Islam Zween

Islam Zween

By Islam Zween

It is uncommon for a country experiencing strong economic growth—characterized by rising investments, progress on major projects, and overall vibrant economic activity—to announce a substantial budget deficit of 165 billion riyals publicly.

It’s as if the government is telling those who read its budget: “A deficit is sometimes not a shortfall, but a tool.”

In economics, there are times when you need to go against the current so that the current doesn’t sweep you away. In economists’ language, counter-cyclical fiscal measures can be crucial for maintaining sustained economic stability.

Saudi Arabia's intentional shift toward a deficit, rather than one caused by necessity, prompts questions about the strategic reasons behind this decision. And here’s a question: how does this choice fit with a nuanced understanding of the economic cycle, rather than diverging from it?

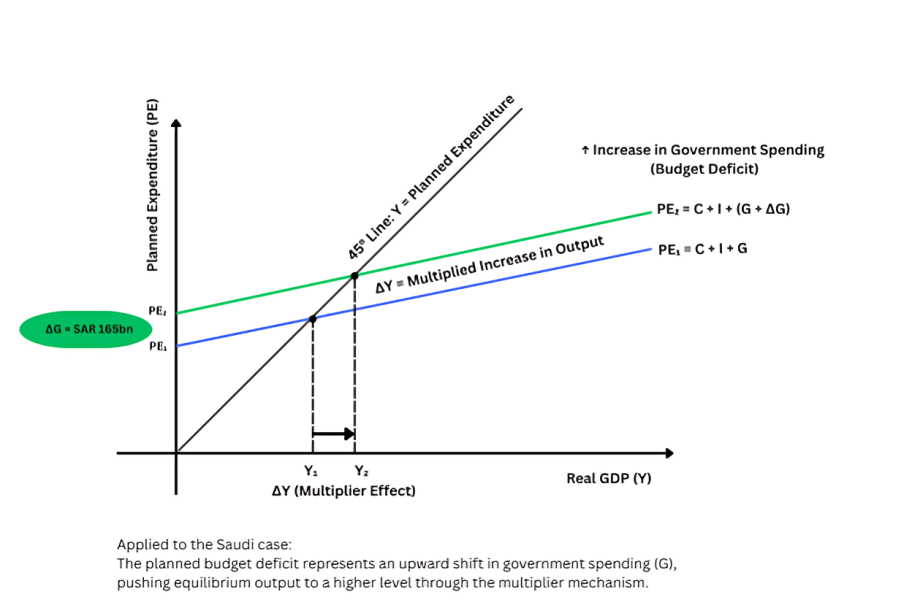

The practical justification for this approach may come from the ninety-year-old Keynesian multiplier economic theory. Understanding this theory fundamentally changes the traditional view of what a "deficit" really means.

The Keynesian multiplier, developed by British economist John Maynard Keynes, suggests that government spending influences the economy beyond its initial amount. This happens through successive rounds of spending, income, and consumption across the economy.

Every dollar the government spends on a project, passing through companies, workers, suppliers, and service providers, results in much of that money cycling back into the economy. This process amplifies the economic impact of the initial expenditure, making it larger than the actual outlay.

Applying this concept to modern economies raises key questions. These include measuring the actual size of the multiplier effect in Saudi Arabia, understanding how much of that spending stays in the country versus how much leaks out as imports, and assessing whether government spending mainly supports sectors with high employment and income potential.

These observations do not disprove the theory but instead provide a more detailed understanding of how economic impact unfolds in reality.

Saudi Arabia's fiscal policy reflects a deliberate strategy of expansion, though it comes with challenges. The planned budget focuses heavily on capital spending in infrastructure, logistics, tourism, and housing projects. These sectors typically have high multiplier effects because they are deeply connected to wider supply chains and can generate many jobs at various levels.

Implementing projects quickly introduces three major challenges that need close attention. First, there’s concern about the private sector's capacity to absorb this growth, as increased competition for labor and resources could lead to inflation or supply shortages.

Second, the key is how effectively these investments are converted into long-term productivity. The real economic benefits will only show once projects move from construction to operational phases, delivering tangible results.

Lastly, the medium-term fiscal outlook requires speeding up structural economic changes while ensuring long-term financial health—an ongoing balancing act that remains central to future budget planning.

Analytical Perspective: Connecting the Saudi Approach with Keynesian Ideas

Saudi Arabia’s economic plans align with Keynesian principles in two main ways. First, they involve government spending to support economic activity during certain phases of the cycle. Second, they target sectors with high multiplier effects that also help transform the economy structurally.

However, their underlying goals differ. While Keynesian theory primarily aims to cushion recessions and downturns, Saudi Arabia uses the same fiscal tool—government spending-to drive long-term economic transformation.

In this context, the multiplier isn’t just about boosting demand but about creating new productive capacities and diversifying the economy.

Despite these differences, Saudi fiscal policy remains actively aimed at reducing economic volatility and supporting growth during transitional periods.

The expected Saudi deficit should be viewed within the context of large-scale projects and investments underway. It’s mainly investment-driven, designed to smooth out economic fluctuations during the restructuring process envisioned by the Saudi Vision.

However, understanding this better requires ongoing attention to two key factors: how efficiently government spending translates into sustainable productive capacity, and whether the private sector can keep pace with rapid project execution and broader impacts.

Viewed this way, the deficit becomes part of managing economic transformation rather than just a sign of fiscal weakness. Its value is in strengthening future growth and boosting economic diversification.

Significant changes aren’t driven only by financial numbers but by a clear understanding of the economy's long-term needs. The most important aspect of the new budget is its potential to redefine what a deficit truly signifies. It is no longer merely a sign of fiscal strain but a strategic tool for fostering the economic growth Saudi Arabia aims to achieve.

Ultimately, the effectiveness of this approach will depend on execution and outcomes, not on theoretical validity alone.

Comments {{getCommentCount()}}

Be the first to comment

رد{{comment.DisplayName}} على {{getCommenterName(comment.ParentThreadID)}}

{{comment.DisplayName}}

{{comment.ElapsedTime}}

Most Read

Market Indices

Popular Links

Quick Links

About Us

Join Us

Argaam Investment Company has updated the Privacy Policy of its services and digital platforms. Know more about our Privacy Policy here.

Argaam uses cookies to personalize content, to provide social media features and analyze traffic, that we might also share with third parties. You consent to our cookies if you use this website

Comments Analysis: