Walaa Cooperative Insurance Co. announces its Interim Financial Results for the period ending on 2025-09-30 ( Nine Months )

| Element List | Current Period | Similar period for previous year | %Change |

|---|---|---|---|

| Insurance Revenues | 2,349,232 | 2,460,682 | -4.529 |

| Result of Insurance Services | 1,034,388 | 1,016,316 | 1.778 |

| Net Profit (Loss) of The Insurance Results | -127,841 | -13,562 | 842.641 |

| Net Profit (Loss) of The Investment Results | 47,234 | 119,679 | -60.532 |

| Net Insurance Financing Expenses | -7,114 | -7,703 | -7.646 |

| Net Profit (Loss), After Zakat, Attributable To Shareholders | -127,025 | 84,402 | - |

| Total Comprehensive Income | -122,009 | 84,402 | - |

| Total Shareholders Equity (after Deducting Minority Equity) | 1,709,572 | 1,356,197 | 26.056 |

| Profit (Loss) per Share | -1 | 0.83 | |

| All figures are in (Thousands) Saudi Arabia, Riyals | |||

| Element List | Amount | Percentage of the capital (%) | |

|---|---|---|---|

| Profit (Losses) Resulting From The Change In Investment Propertie’s Fair Value | - | - | |

| Accumulated Losses | 9,231 | 0.72 | |

| All figures are in (Thousands) Saudi Arabia, Riyals | |||

| Element List | Explanation |

|---|---|

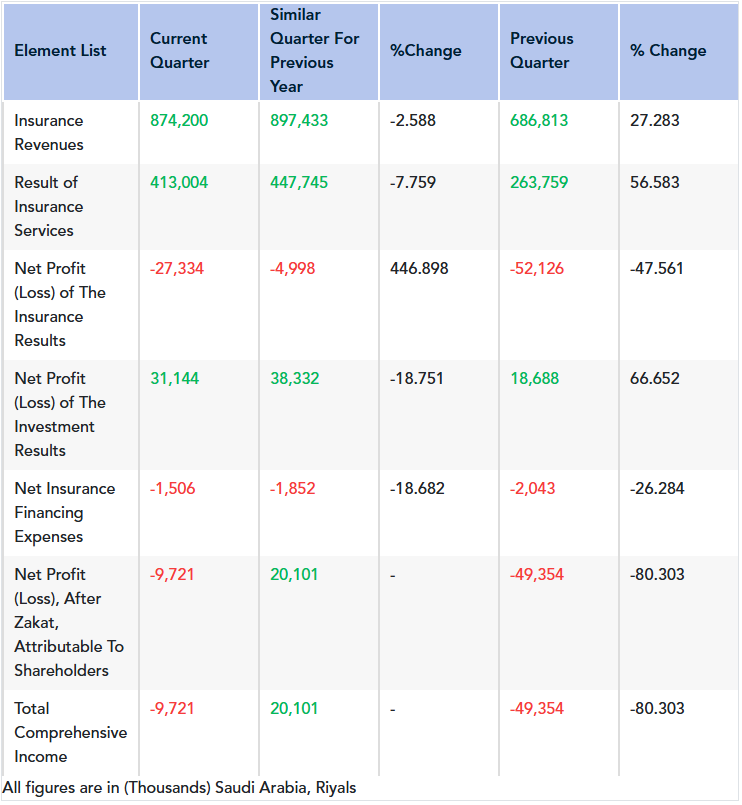

| The reason of the increase (decrease) in the revenues during the current quarter compared to the same quarter of last year is |

Insurance revenues for the current quarter amounted to SAR 874,200 thousand, compared to insurance revenues amounting to SAR 897,433 thousand of the same quarter of last year. This represents a decrease of 2.59%.

This is mainly due to a decrease in Insurance revenues in Medical, Motor, Engineering P&S Non-linked and property segments, representing a decrease of 43.17%, 8.26%, 23.45%, 33.59% and 3.41% respectively. This decrease in insurance revenues is partially offset by an increase in insurance revenues in Energy by 63.65%. |

| The reason of the increase (decrease) in the net profit during the current quarter compared to the same quarter of the last year is |

Net Loss before zakat and income tax for the current quarter amounted to SAR 4,570 thousand compared to Net income before zakat and income tax amounting to SAR 23,851 thousand of the same quarter of last year.

Net Loss after zakat and income tax excluding minority interest for the current quarter amounted to SAR 9,721 thousand compared to Net income after zakat and income tax (no minority interest) amounting to SAR 20,101 thousand of the same quarter of last year. The core reasons for the net loss after zakat and tax excluding minority interest for the current quarter comprise the following:

• Net Insurance service result (loss) for the current quarter amounted to SAR 27,334 thousand, compared to a loss of SAR 4,998 thousand during the comparative quarter. The insurance service loss for the current quarter was mainly driven by Motor and P&S Non-linked segments.

• Net investment income for the current quarter amounted to SAR 31,144 thousand, compared to net investment income amounting to SAR 38,332 thousand during the same quarter of the previous year. This decrease in investment income for the current quarter was mainly driven by decrease in realized and unrealized gains on equities compared to realized and unrealized gains on equities in the same quarter of the previous year.

• Other operating expenses for the current quarter, which amounted to SAR 10,306 thousand compared to SAR 8,332 thousand during the same quarter of the previous year, representing an increase of 23.69%. |

| The reason of the increase (decrease) in the revenues during the current quarter compared to the previous quarter is |

Insurance revenues for the current quarter amounted to SAR 874,200 thousand, compared to insurance revenues amounting to SAR 686,813 thousand of the previous quarter, which represents an increase of 27.28%.

This is mainly due to increase in Insurance revenues in Energy, and Engineering segments, representing an increase of 804.54%, and 10.84%, respectively. This increase in insurance revenues is partially offset by a decrease in insurance revenues in Medical, Motor, Property, and P&S Non-linked segments by 11.82%, 3.55%, 9.68% and 17.62% respectively. |

| The reason of the increase (decrease) in the net profit (loss) during the current quarter compared to the previous quarter is |

Net Loss before zakat and income tax for the current quarter amounted to SAR 4,570 thousand compared to Net Loss before zakat and income tax amounting to SAR 44,177 thousand of the previous quarter, which represents a decrease of 89.66%.

Net loss after zakat and income tax excluding minority interest for the current quarter amounted to SAR 9,721 thousand compared to a Net loss after zakat and income tax excluding minority interest amounting to SAR 49,354 thousand of the previous quarter, which represents a decrease of 80.30%. The core reasons for the decrease in net loss after zakat and tax excluding minority interest for the current quarter compared with the previous quarter comprise the following:

• Net Insurance service result (loss) for the current quarter amounted to SAR 27,334 thousand, compared to a loss of SAR 52,126 thousand during the previous quarter, which represents a decrease of 47.56%. This reduction in loss is mainly attributable to better performance in Medical, Property, and Energy segments.

• Net investment income for the current quarter amounted to SAR 31,144 thousand, compared to net investment Income amounting to SAR 18,688 thousand during the previous quarter, which represents an increase of 66.65%. The income from investments for the current quarter was mainly driven by the realized and unrealized gains on equities compared to realized and unrealized losses on equities in the previous quarter.

• Other operating expenses for the current quarter which amounted to SAR 10,306 thousand compared to SAR 11,911 thousand during the previous quarter, representing a decrease of 13.47%. |

| The reason of the increase (decrease) in the revenues during the current period compared to the same period of the last year is |

Insurance revenues for the current period amounted to SAR 2,349,232 thousand, compared to insurance revenues amounting to SAR 2,460,682 thousand of the previous period, which represents a decrease of 4.53%.

This is mainly due to a decrease in Insurance revenues in Medical, Motor, Energy, Engineering and P&S Non-linked segments, representing a decrease of 38.94%, 9.47%, 2.24%, 23.01% and 26.78% respectively. This decrease in insurance revenues is partially offset by an increase in insurance revenues in Property and P&C Other segments by 55.81% and 17.88% respectively. |

| The reason of the increase (decrease) in the net profit during the current period compared to the same period of the last year is |

Net Loss before zakat and income tax for the current period amounted to SAR 111,697 thousand compared to Net Income before zakat and income tax amounting to SAR 93,402 thousand of the previous period.

Net loss after Zakat and income tax excluding minority interest for the current period amounted to SAR 127,025 thousand compared to Net Income after zakat and income tax (no minority interest) amounting to SAR 84,402 thousand of the previous period. The core reasons for the net loss after zakat and tax excluding minority interest for the current period compared with the previous period comprise the following:

• Net Insurance service result (loss) for the current period amounted to SAR 127,841 thousand, compared to a loss of SAR 13,562 thousand during the previous period, which represents an increase of 842.64%. This increase in loss is mainly attributable to Motor, Engineering and P&S Non-linked segments, representing a decrease of 817.93%, 60.61 and 211.12% respectively.

• Net investment income for the current period amounted to SAR 47,234 thousand, compared to net investment income amounting to SAR 119,679 thousand during the previous period which represents a decrease of 60.53%. This decrease in investment income for the current period was mainly driven by realized and unrealized losses on equities compared to realized and unrealized gains on equities in the same period of the previous year.

• Other income for the current period amounted to SAR 2,144 thousand, compared to SAR 22,474 thousand during the same period of the previous year, which represents a decrease of 90.46%. Last year's other income was mainly driven by the disposal of land, which realized a gain of SAR 20,308 thousand.

• Other operating expenses for the current period amounted to SAR 31,308 thousand compared to SAR 27,486 thousand during the same period of the previous year, representing an increase of 13.91%. |

| Statement of the type of external auditor's report | Unmodified conclusion |

| Comment mentioned in the external auditor’s report, mentioned in any of the following paragraphs (other matter, conservation, notice, disclaimer of opinion, or adverse opinion) | None |

| Reclassification of Comparison Items | Certain comparative figures have been reclassified to conform to the change in the presentation methodology adopted by the company in the current period. However, there is no financial impact of these reclassifications on net income attributable to shareholders and equity. |

| Additional Information |

The Loss Per Share is calculated on Net Loss after Zakat and Income Tax excluding minority interest for the current period divided by the weighted average number of ordinary shares outstanding during the current period. The loss per share for the current period is SAR 1.00 per share versus restated earnings per share of SAR 0.83 for the comparative period which is calculated by dividing the net loss after zakat and income tax excluding minority interest amount of SAR 127,025 thousands over the weighted average number of ordinary outstanding shares of 127,558 thousand for the current period, and the net income after zakat and income tax (no minority interest) of SAR 84,402 thousands over the adjusted weighted average number of ordinary outstanding shares of 101,722 thousand for the comparative period.

During 2024, the Company undertook a rights issue and increased the share capital from SAR 850,583 thousand to SAR 1,275,583 thousand through offering a total of 42.5 million ordinary shares of a nominal value of SAR 10 per share, with an offer price of SAR 11 per share. The number of ordinary issued shares before the rights issue was 85,058 thousand, which was adjusted by 16,664 thousand shares to 101,722 thousand ordinary shares to compute EPS for the comparative period.

Total Shareholders' Equity excluding minority interest at the end of the current period is SAR 1,709,572 thousand versus SAR 1,356,197 thousand as at the end of the comparative period, which represents an increase of 26.06%. Minority interest at the end of the current period is SAR 2,496 thousand (no minority interest in previous period).

Total comprehensive loss for the current period excluding minority interest amounted to SAR 122,009 thousand, compared to a total comprehensive income (no minority interest) amounted to SAR 84,402 thousand for the comparative period.

Moreover, Gross Written Premiums for the current period amounted to SR 2,393,088 thousand, compared to SAR 2,779,960 thousand for the same period last year, representing a decrease of 13.92%.

During the current period, the Company acquired 88% ownership of Aspire Underwriting Agency Ltd (ASPIRE), a Managing General Agent (MGA) based in Dubai International Financial Center (DIFC), UAE. The acquisition is in line with Walaa’s interest to expand and diversify its inward reinsurance business. The investment is approximately SAR 68 million and the transaction is expected to make positive impact in Walaa financials. Post acquisition, the revenue of Aspire amounted to SAR 5,188 thousand. |

Comments {{getCommentCount()}}

Be the first to comment

رد{{comment.DisplayName}} على {{getCommenterName(comment.ParentThreadID)}}

{{comment.DisplayName}}

{{comment.ElapsedTime}}

Comments Analysis: