A look on Nomu performance YTD, new listings

Stocks showed mixed performance on Nomu year to date

The Nomu-Parallel Market Capped Index (NomuC) closed at 25,026 points on Sept. 11, 2025, down 19% (5,900 points) from trading close on Dec. 31, 2024.

On Feb. 16, the index hit its highest close year-to-date (YTD), at 31,737.18 points.

The market value of issued shares stood at SAR 54.32 billion by the end of H1 2025, a decline of 1.65% year-on-year (YoY).

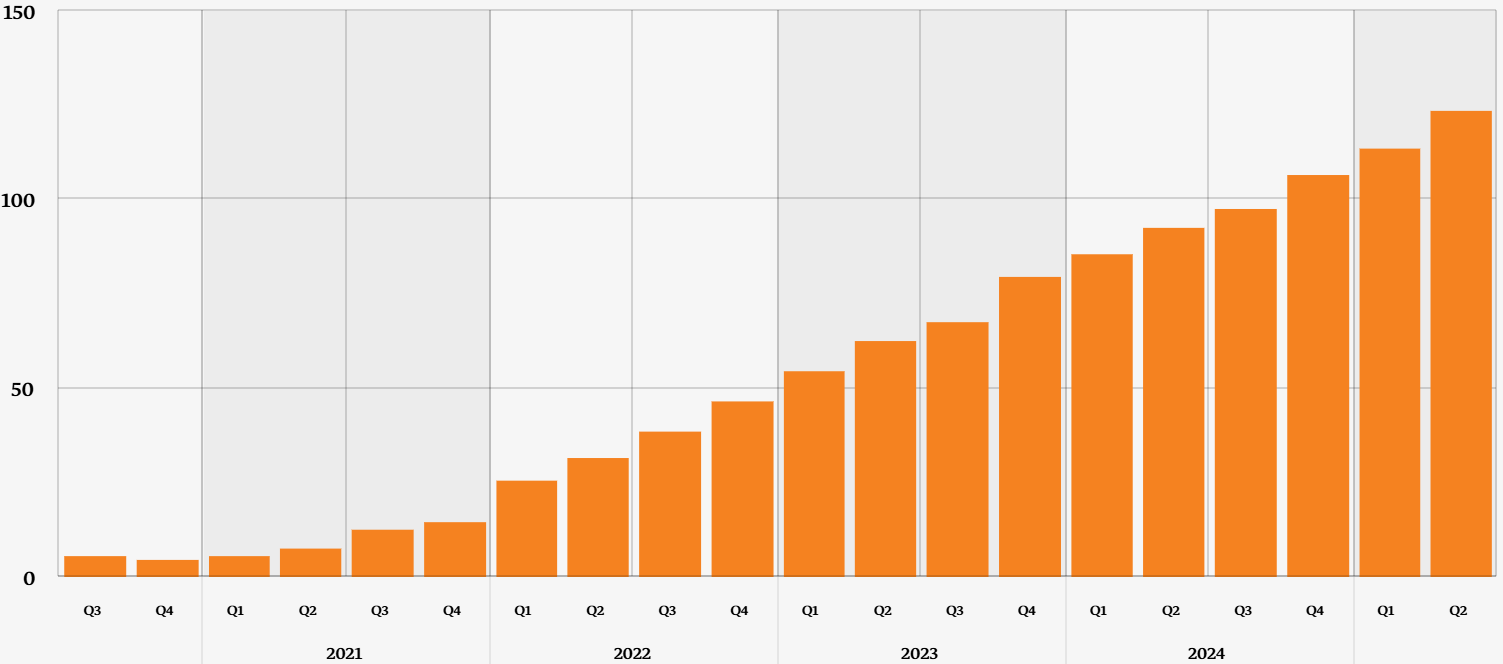

The number of listed companies on Nomu grew to 125 by Sept. 11, after the addition of two firms: National Signage Industrial Co. (Signworld) and Naf Co. for Feed for Industry.

Meanwhile, Raoom Trading Co. moved from Nomu to the Main Market (TASI) on Jan. 27. Saudi Azm for Communication and Information Technology Co. and Obeikan Glass Co. shifted to TASI on July 21.

Number of companies listed on Nomu increased (Source: Argaam Tools)

Stock performance on Nomu varied YTD, until Sept. 11. Bottles and bags manufacturer Arabian Plastic Industrial Co. (APICO) was the top gainer with a jump of nearly 60% in stock value, followed by Al Rashid Industrial Co., which rose nearly 42%.

|

Best Performers (by Sept. 11, 2025) |

||||

|

Company |

Activity |

Price (Jan. 1) |

Price (Sept. 11) |

Change |

|

APICO |

Manufacturer of containers, boxes |

25.40 |

40.80 |

+60.62% |

|

Al Rashid Industrial |

Plastic packaging |

45.15 |

64.00 |

+41.75% |

|

Al-Jouf Water |

Bottled mineral water |

1.35 |

1.90 |

+40.74% |

|

Adeer (listed May 26, 2025) |

Real estate marketing & sales management |

89.20 |

124.50 |

+39.57% |

|

Nofoth |

Food & beverage sales |

9.01 |

11.41 |

+26.68% |

|

Mulkia |

Securities & investment management |

30.79 |

37.50 |

+21.79% |

|

Anmat (listed June 11, 2025) |

ICT services |

9.95 |

11.44 |

+14.79% |

|

IHR |

HR & general admin services |

4.83 |

5.52 |

+14.29% |

|

TAQAT |

Iron billets |

11.64 |

13.20 |

+13.40% |

|

Alwasail |

Polyethylene pipes |

2.95 |

3.33 |

+12.88% |

|

Asas Makeen (listed June 11, 2025) |

Real estate development & investment |

91.50 |

97.90 |

+6.99% |

|

Lana |

Hospitals & medical centers services |

28.65 |

30.00 |

+4.72% |

|

UFG |

Glass & mirrors manufacturing |

38.00 |

39.70 |

+4.47% |

|

AOL |

Education & training |

9.70 |

10.12 |

+4.33% |

|

Almujtama Alraida |

Pharmaceuticals, medical & cosmetics sales |

30.00 |

31.20 |

+4.00% |

On the losers’ side, Future Care Trading Co. topped the list of declining stocks YTD, after recording sharp gains in 2023 and 2024.

Jana Medical Co. came in second, falling nearly 73%, as the company continued to report losses.

Balady Poultry Co. ranked third, down about 80%, after strong stock gains in 2024 despite weaker earnings this year.

|

Worst Performers (by Sept. 11) |

||||

|

Company |

Activity |

Price (Jan. 1) |

Price (Sept. 11) |

Change |

|

Future Care |

Home healthcare & lab services |

9.68 |

2.48 |

(74.38%) |

|

Jana Medical |

Import & supply of medical devices |

43.45 |

11.90 |

(72.61%) |

|

Balady Poultry |

Poultry meat production |

382.40 |

128.50 |

(66.40%) |

|

Al Battal Factory |

Saline aid & thermal coating products |

58.70 |

22.50 |

(61.67%) |

|

Dar Almarkabah |

Car rental |

4.13 |

1.60 |

(61.21%) |

|

DRC |

Market research, consulting & data analysis |

78.00 |

33.90 |

(56.54%) |

|

Molan |

Iron products supply |

3.77 |

1.80 |

(52.25%) |

|

AICTEC |

Technology & security solutions |

4.26 |

2.20 |

(48.36%) |

|

Mufeed |

Events & exhibitions management |

71.70 |

37.50 |

(47.70%) |

|

TAM |

Consulting & project management |

182.00 |

96.60 |

(46.92%) |

|

NGDC |

Natural gas distribution |

64.90 |

34.88 |

(46.26%) |

|

Arabica Star |

Coffee shop operations |

77.50 |

43.10 |

(44.39%) |

|

Leaf Global |

Environmental impact assessment |

103.60 |

59.00 |

(43.05%) |

|

SAMA Water |

Bottled mineral water |

3.92 |

2.24 |

(42.86%) |

|

Saudi Parts Center |

Auto spare parts wholesale & retail |

60.80 |

35.32 |

(41.91%) |

In 2025, nearly 20 companies listed on Nomu. Most of them saw weaker performance, reflecting the performance pullbacks in TASI and Nomu.

Fifteen newly listed firms recorded losses, with Shmoh Almadi Co. (SMC), Service Equipment Co., and Dkhoun National Trading Co. among the worst performers, each falling about 40%.

|

New Listings on Nomu |

||||

|

Company |

Listing Date |

Offer Price (SAR) |

Price as of Sept. 11 |

Change |

|

Shmoh Almadi |

Jan. 13 |

22.00 |

12.60 |

(43%) |

|

Itmam |

Jan. 23 |

15.00 |

14.70 |

(2%) |

|

Alshehili |

Jan. 29 |

80.00 |

54.10 |

(32%) |

|

Twareat |

Jan. 29 |

12.00 |

13.22 |

+10% |

|

Smile Care |

Feb. 3 |

4.40 |

5.00 |

+14% |

|

Lamasat |

Feb. 9 |

5.75 |

5.65 |

(2%) |

|

Hedab Alkhaleej |

Mar. 5 |

52.00 |

41.00 |

(21%) |

|

RATIO |

Mar. 9 |

10.00 |

8.13 |

(19%) |

|

Future Vision |

Apr. 27 |

7.00 |

6.85 |

(2%) |

|

Service Equipment |

May 4 |

84.00 |

50.80 |

(40%) |

|

Dkhoun |

May 20 |

121.00 |

71.30 |

(41%) |

|

Adeer |

May 26 |

85.00 |

124.50 |

+46% |

|

Axelerated Solutions |

Jun. 1 |

27.00 |

26.86 |

(1%) |

|

Al Kuzama |

Jun. 2 |

107.00 |

73.00 |

(31%) |

|

Anmat |

Jun. 11 |

9.50 |

11.44 |

+20% |

|

Asas Makeen |

Jun. 16 |

80.00 |

97.90 |

+22% |

|

Time Entertainment |

Jun. 17 |

80.00 |

59.00 |

(26%) |

|

Hawyia |

Jun. 22 |

13.00 |

12.79 |

(2%) |

|

Signworld |

Sept. 3 |

12.00 |

11.76 |

(16%) |

|

Naf |

Jul. 20 |

76.00 |

55.80 |

(26.7%) |

Nearly 20 Nomu-listed companies received board approvals to move to TASI. The earliest was Canadian Medical Center Co. (CMCER) in 2023, while the most recent was Armah Sports Co., whose board approved the transfer on June 15, 2025, as shown in the following table:

|

Transitions to TASI (by Sept. 9) |

||

|

Company |

Activity |

Board Approval Date |

|

Armah |

Sports clubs |

June 15, 2025 |

|

Al-Modawat |

Al-Mudawah Hospital |

June 2, 2025 |

|

Al-Jouf Water |

Mineral water bottling |

May 15, 2025 |

|

United Mining |

Gypsum and fiber cement |

Apr. 14, 2025 |

|

Horizon Food |

Meat and poultry production, processing, and packaging |

Apr. 3, 2025 |

|

Rawasi Albina |

Electrical and telecom wiring |

Feb. 17, 2025 |

|

WAJA |

Interior design |

Feb. 16, 2025 |

|

Nofoth |

Food products |

Jan. 13, 2025 |

|

GAS |

Services for oil, gas, petrochemicals, and power sectors |

Jan. 4, 2024 |

|

Saudi Top |

Wholesale of primary plastics |

Nov. 4, 2024 |

|

Knowledge Tower |

Wholesale and retail of stationery |

Nov. 20, 2024 |

|

Watani Steel* |

Steel manufacturing and scrap sales |

May 26, 2024 (Rejected) |

|

Edarat |

Virtual network operator services |

Apr. 18, 2024 |

|

Future Care |

Home healthcare and lab services |

Feb. 19, 2024 |

|

AOL |

Education and training (higher education institutes) |

Jun. 30, 2024 |

|

Alwasail** |

Polyethylene plastic pipe production |

Jun. 12, 2024 |

|

Ladun |

Real estate investment and development |

Oct. 23, 2023 |

|

Tadweeer |

E-waste recycling |

Aug. 13, 2023 |

|

CMCER |

Medical centers and clinics |

Jul. 9, 2023 |

|

Sure |

Technical and management consultancy services |

Feb. 24, 2024 |

|

IHR |

Human resources and public administration services |

Sept. 28, 2023 |

|

Care |

Project solutions, services, operation and maintenance |

Dec. 25, 2023 |

|

AlNaqool |

Ready-mix concrete production |

Nov. 15, 2023 |

|

Mobi |

Detergents, fertilizers, and plastics manufacturing |

Jun. 18, 2023 |

|

NGDC |

Natural gas distribution |

May 15, 2024 |

|

AME |

Retail of medical devices, equipment, and supplies |

Dec. 13, 2023 |

|

Fesh Fash |

Corn and potato snacks (chips) manufacturing |

Apr. 6, 2023 |

**Alwasail withdrew its application for not meeting transfer requirements.

Nearly 11 IPOs have been canceled since the launch of Nomu-Parallel Market. This year saw the highest number of offering cancellations compared to the previous years, including the offerings of Rawabi Marketing International Co., Dom International Investment Co., and Al-Khaldi Logistics Co., as well as the scrapped International Unions for Trade Co. (IUTC) IPO before launch.

Comments {{getCommentCount()}}

Be the first to comment

رد{{comment.DisplayName}} على {{getCommenterName(comment.ParentThreadID)}}

{{comment.DisplayName}}

{{comment.ElapsedTime}}

Comments Analysis: